'Common Sense' Is Actually Uncommon: Charlie Munger Said 'Standard Human Condition Is Ignorance And Stupidity'

Charlie Munger, the renowned late Vice Chairman of Berkshire Hathaway (NYSE:BRK)(NYSE:BRK), always challenged conventional wisdom in investing, particularly the concept of “common sense.”

In a candid discussion, Munger pointed out that what people often refer to as common sense in investing is actually quite rare. “When people use the word ‘common sense,’ what they mean is uncommon sense,” he said.

Munger argued in 2019 that the human condition leans more towards ignorance rather than wisdom. This inherent lack of clarity and understanding is why truly insightful and prudent investment decisions are uncommon.

He said, “The standard human condition is ignorance and stupidity.”

Why It’s Important: This perspective from Munger challenges investors to rethink their assumptions and approach to investing. It implies that what might seem like straightforward or obvious decisions in hindsight often require a level of insight and understanding that is not commonly found among average investors.

The comments from Munger come as the late investor realized decades of strong gains as vice chairman of Berkshire Hathaway.

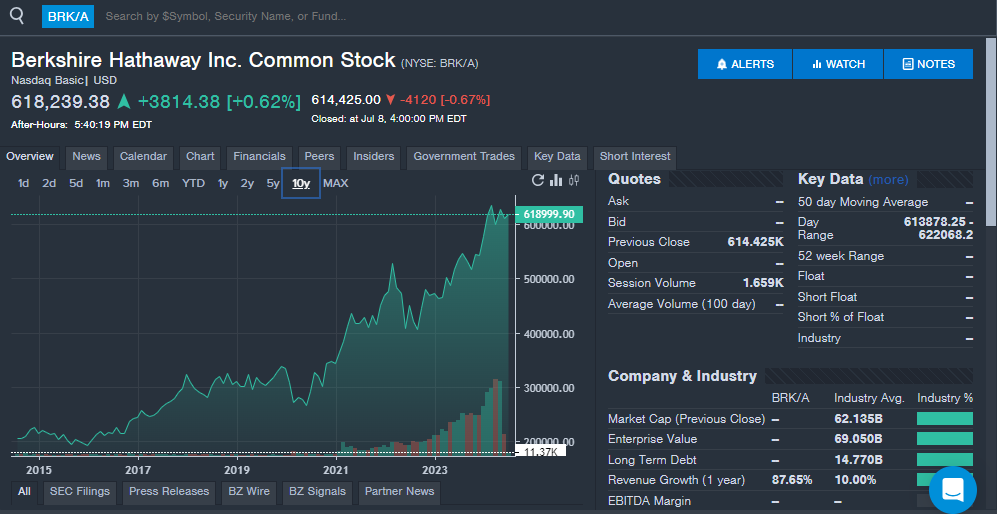

The chart from Benzinga Pro below shows the strong returns of Berkshire Hathaway over the last 10 years. Berkshire Hathaway shares are up 220% over the last 10 years, outperforming the S&P 500, which is up 181% over the same time period.

Munger’s critique pushes for a deeper, more analytical approach to investing, one that goes beyond surface-level reasoning.

Munger’s insights are particularly valuable in a time when markets are volatile, and investors are looking for reliable strategies. His emphasis on uncommon sense suggests that successful investing requires going against the grain, thinking critically, and questioning widely accepted norms.

This approach has been a cornerstone of Munger's and Warren Buffett's success at Berkshire Hathaway, demonstrating that true investment wisdom is indeed rare and precious.

Read Next:

This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image created using artificial intelligence via Midjourney.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Charlie Munger common sense investing advice Pro Project Warren BuffettEducation Top Stories