Evidence Venture Capital Funding Has Peaked

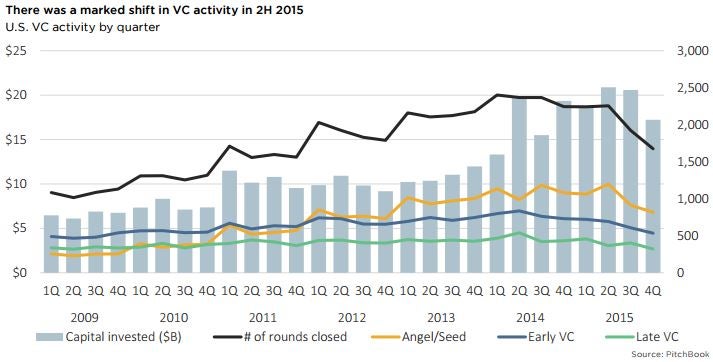

According to PitchBook’s annual report, venture capital funding has peaked and is now headed lower. After concerns over rising valuations and constant streams of unicorn births began to arise in 2014, PitchBook notes that investors finally started to become cautious in the space in the second half of 2015.

The number of U.S. venture rounds closed plunged 25.8 percent from Q2 to Q4 2015. However, editor Garret Black notes that there was still an incredible amount of activity on the year.

Related Link: Record Auto Sales Fueled By Debt, Likened To Subprime Mortgage Market By Regulators

“The investment environment is particularly complex right now, what with limited partners still funneling plenty of capital to VC fund managers as recent venture returns tick upward, concerns around Asian growth prospects persisting, and liquidity prospects staying uncertain for the short-term,” Black writes.

The PowerShares Listed Private Eq. (ETF) (NYSE: PSP) is down 12.5 percent in the past six months.

Disclosure: the author holds no position in the stocks mentioned.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: News Education Specialty ETFs Econ #s Top Stories Economics Startups Small Business Best of Benzinga