Earnings Speculation Drives Intrigue For Direxion's TSLA-Focused Bull And Bear Funds

Next week, all eyes will be on electric vehicle leader Tesla Inc. (NASDAQ:TSLA) as the company is scheduled to release its financial results for the second quarter. Analysts will be looking for earnings per share of 42 cents on revenue of $22.79 billion. In the year-ago quarter, Tesla posted EPS of 52 cents on sales of $25.5 billion, thus reflecting significant changes in the broader EV ecosystem.

Nevertheless, the bulls will be looking for positive signals — and they wouldn't be unjustified in their optimism. Fundamentally, one of the most significant catalysts for Tesla's business is last month's rollout of its Robotaxi model. Admittedly, the EV manufacturer is new to the space and faces significant competition from Uber Technologies, Inc. (NYSE:UBER) and Waymo. However, with the Robotaxi launch, there's much buzz about the expansion of the initiative.

Another potential tailwind may stem from Tesla's energy-related division. In June, the company announced that it had signed an energy storage deal with Shanghai amid trade uncertainty between Washington and Beijing. Specifically, Tesla will set up its first grid-scale energy storage station in Shanghai using the company's Megapack batteries, per a Reuters report. The deal involves an investment of over 4 billion yuan or $550 million.

Finally, in terms of bullish factors, it's difficult to ignore the resilience of TSLA stock. For example, in the first quarter, Tesla delivered disappointing results, missing on both the top and bottom lines. Yet TSLA stock was no worse for wear, soaring higher despite the ugly print.

Although the positives seem robust, the EV maker isn't without concerns. One of the biggest headwinds is also the most conspicuous from a branding perspective: the unraveling of the Cybertruck. Initially, Tesla CEO Elon Musk had grand ambitions for the futuristic ride, with a planned production capacity of 250,000 vehicles annually. However, last year, only 38,965 Cybertrucks were sold, with recent data suggesting the sales trend could be stalling even more.

Furthermore, the competition is heating up. Last month, BYD Co. Ltd. (OTC:BYDDY) (OTC:BYDDF) sent a shot across the bow by edging past Tesla in terms of global sales for the first time. This remarkable development can be attributed to BYD's expansion in multiple regions, particularly the European market.

The Direxion ETFs: With narratives clashing on the EV expressway, sentiment-agnostic traders have an opportunity to play both sides with Direxion's exchange-traded funds. For the optimists, the Direxion Daily TSLA Bull 2X Shares (NASDAQ:TSLL) track 200% of the performance of TSLA stock. For pessimistic traders, the Direxion Daily TSLA Bear 1X Shares (NASDAQ:TSLS) track 100% of the inverse performance of the namesake security.

In either case, the main function of these Direxion ETFs is to provide a convenient mechanism for speculation. Typically, traders who wish to use leverage or to open short positions must engage the options market. However, financial derivatives carry complexities that not all investors want to accept. In contrast, Direxion ETFs can be bought and sold much like any other publicly traded security, thus mitigating the learning curve.

Still, prospective participants must be aware of these funds' unique risks. First, leveraged and inverse ETFs tend to be more volatile than standard funds tracking a benchmark index like the S&P 500. Second, Direxion ETFs are designed for exposure lasting no longer than one day. Holding beyond the recommended period could lead to value decay due to daily compounding.

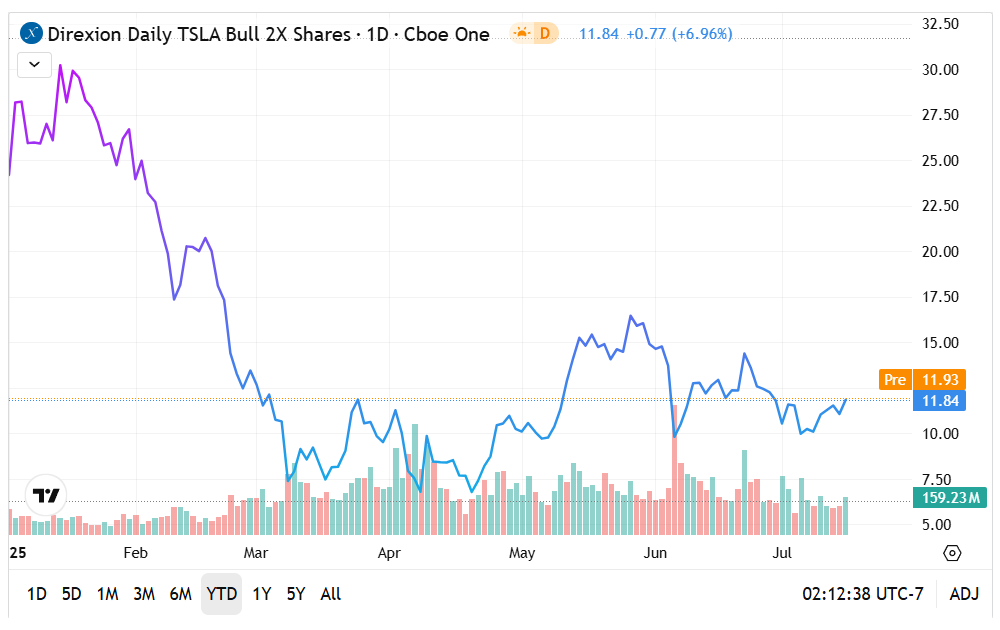

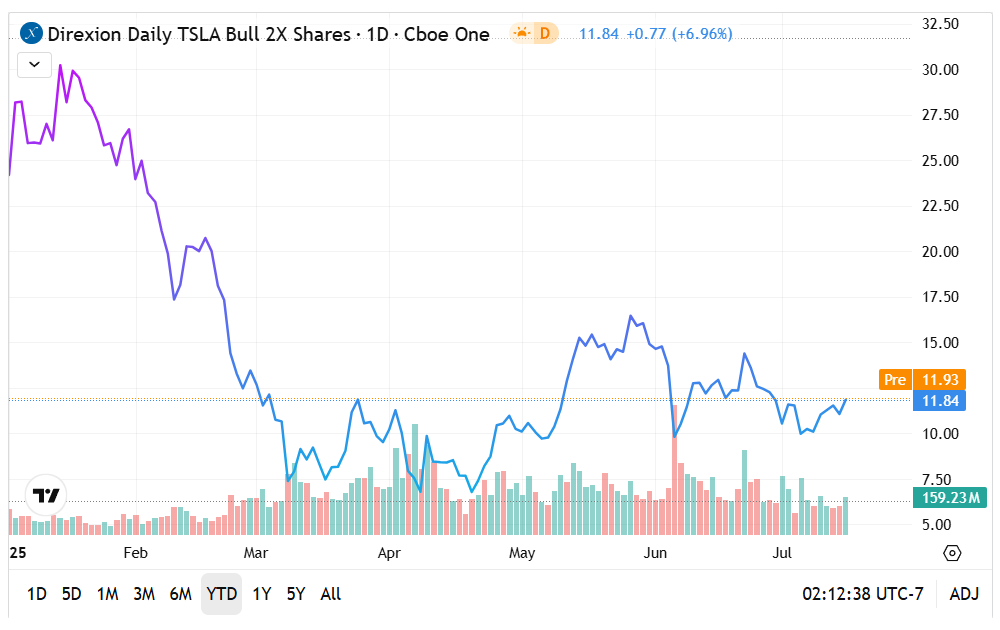

The TSLL ETF: Since the start of the year, the TSLL ETF has suffered significant volatility, losing just under 57% amid Tesla's competitive challenges.

- Presently, the Tesla bull fund is trading below both its 50-day moving average and the 200 DMA, reflecting broader weakness.

- However, it's also possible that the TSLL ETF may be charting a pennant formation, which could suggest a sentiment reversal.

The TSLS ETF: While a better relative performer than its counterpart, the TSLS ETF is still down about 5% on a year-to-date basis.

- Curiously, the TSLS ETF also finds itself struggling below its 50 and 200 DMAs, though the underperformance to the former is less pronounced.

- Recently, a spike in distributive volume has materialized in the TSLS ETF, which may present a risk factor ahead of earnings.

Featured image by ElasticComputeFarm on Pixabay.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: direxion Partner ContentLong Ideas Short Ideas Technicals Trading Ideas ETFs