Gold ETF Bleeds Money At Fastest Pace In 3 Years — Is The Safe-Haven Trade Over?

A major gold exchange-traded fund recorded its steepest capital exodus in nearly three years this May, casting doubts over investor appetite for traditional safe-haven assets—but some analysts suggest the bull cycle is far from over.

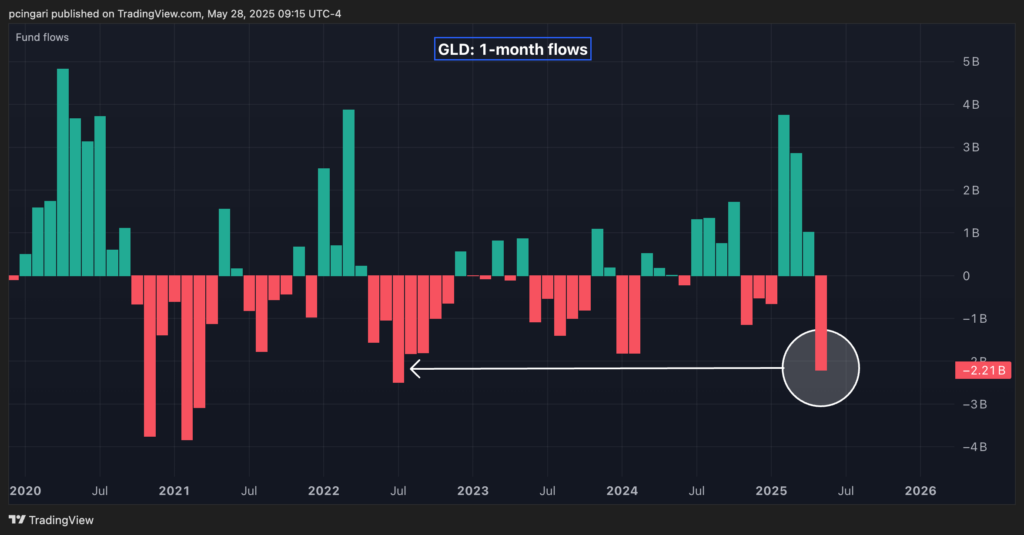

$2.1 Billion Outflows Rock SPDR Gold ETF

The SPDR Gold Trust ETF (NYSE:GLD) saw outflows totaling $2.1 billion in May, marking its worst monthly withdrawal since July 2022.

The sell-off follows three straight months of heavy inflows, during which the fund attracted approximately $7.5 billion, reflecting a major reversal in sentiment.

The outflows come as gold prices moved sideways in May, set to close the month broadly unchanged after a robust four-month rally that pushed prices to a record high of $3,500 an ounce in mid-April.

US-China Truce Dampens Demand For Gold

A key reason behind the fading appetite for gold appears to be the May 12 trade agreement between the U.S. and China, which saw both nations slash tariffs by 115 percentage points and resume negotiations.

That same day, gold plunged 2.7%, its sharpest daily decline since November 2024. With geopolitical fears cooling, some traders may be reallocating capital away from defensive assets like gold.

The S&P 500, as tracked by the SPDR S&P 500 ETF Trust (NYSE:SPY), is up 6.7% in May, eyeing its strongest month since November 2023, reflecting investor shift towards riskier assets.

Meanwhile, Bitcoin (CRYPTO: BTC) reached record highs at $112,000, and is up 16% for the month.

Long-Term Bull Run Still Intact?

Despite May's weakness, gold remains one of 2025's standout assets. In the first five months of the year, gold has rallied 26%, outperforming all major asset classes.

For comparison, the S&P 500 is up just 0.6%, the U.S. dollar is down 8%, long-dated Treasuries – tracked by the iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT) – have fallen 3%, and Bitcoin has gained 16%.

Gold's current bullish wave dates back to October 2022, from which prices have doubled. In the past 14 months, gold closed 11 months in positive territory—a clear indication of sustained bullish momentum.

Expert Views: Has Gold Peaked Or Is More to Come?

"It's difficult to work out what gold may do next," said David Morrison, senior market analyst at Trade Nation. He noted that gold's MACD (moving average convergence divergence) momentum indicator has retreated from overbought levels, signaling potential upside.

"While this means that gold has the potential to rally from here…it could be that gold has already topped."

Still, structural demand trends are giving bulls hope.

Goldman Sachs Research expects prices to reach $3,700 per ounce by year-end, driven by safe-haven buying and central bank diversification.

"Long gold positions sharply improve risk-adjusted portfolio returns during periods where U.S. institutional credibility is challenged," Daan Struyven, commodity analyst at Goldman Sachs, said.

He highlighted rising public debt and geopolitical fragmentation as key long-term catalysts for higher gold prices. According to Struyven, if private investors shift even a small portion of assets from equities or Treasuries to gold, the price could exceed $4,000 by mid-2026.

Another persistent tailwind is central bank gold demand, which surged after Western sanctions froze Russia's reserves in 2022. Emerging markets, underweight in gold relative to developed peers, are expected to keep buying aggressively.

Struyven said this trend could account for a 21% base-case gold return by mid-2026.

Now Read:

Image: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Analyst Color Cryptocurrency Macro Economic Events Bonds Broad U.S. Equity ETFs Specialty ETFs Commodities Treasuries