Is A VIX Floor Approaching?

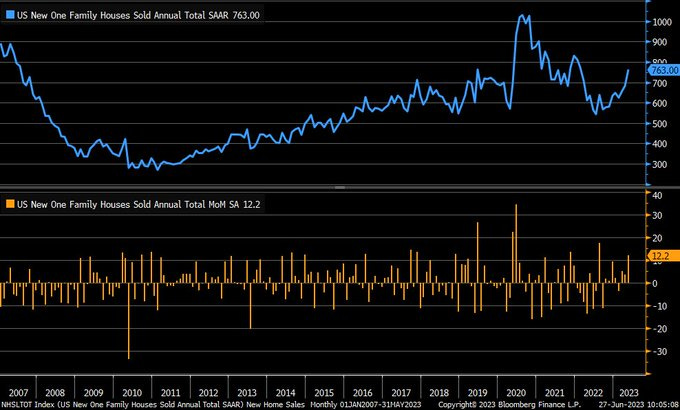

The housing market is resilient. Sales of newly constructed homes were up 12.2% in May from April, and up 20% from a year ago. Homeowners with ultra-low mortgage rates don’t want to sell and buy another home at a much higher rate according to Bloomberg. Will this continue?

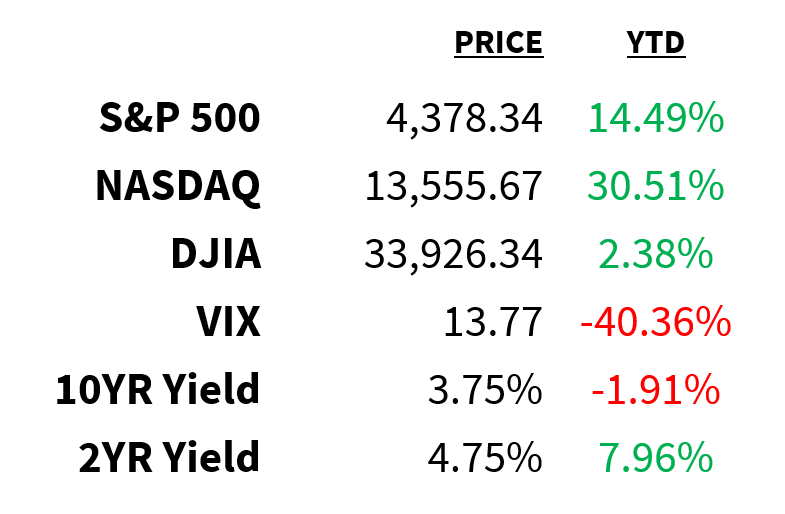

Market

Prices as of 4 pm EST, 6/27/23

Macro

US consumers are feeling more optimistic.

-

The Conference Board’s index of consumer confidence rose to its highest level since January 2022 in June.

-

Consumers’ view on current conditions jumped to its highest in nearly 2 years while their 6-month outlook also improved.

-

Inflation expectations fell to their lowest since 2020.

-

Even so, 69% of consumers still think a recession is likely within the next 12 months.

US business spending on equipment may be bottoming out.

-

Orders for durable goods rose unexpectedly in May for the 3rd straight month.

-

Total sales rose by 1.7% (vs.-1% expected) led by a surge in transportation equipment.

-

Non-defense goods excluding aircrafts—a proxy for business investment—increased by 0.7% (vs. 0% expected).

-

Shipments of core capital goods and non-defense capital goods—which are used in GDP calculations—grew by 0.2% and 3.4%, respectively.

Sales of new US homes increased for the 3rd consecutive month in May, jumping by the most (12.2%) since August 2022 (chart).

-

The median sales price fell 7.6% YoY to $416,300.

-

Meanwhile, Case-Shiller home prices similarly rose for the 3rd straight month with prices increasing 0.5% in April.

-

Despite falling on an annual basis for the first time in 11 years, home prices are just 2.4% below their June 2022 peak.

@lizannsonders

Stocks

“What would you say you do here?” is a question many Credit Suisse workers may soon be facing from their new employer.

-

UBS plans to cut more than half of Credit Suisse’s 45,000 employees.

-

The goal is to reduce the bank’s new combined 120,000-worker headcount by ~30% (35,000).

-

The first of 3 rounds of cuts is expected to begin in July and will continue in September and October.

-

Elsewhere on Wall Street: JPMorgan, Morgan Stanley, and Goldman Sachs have similarly announced thousands of job cuts of their own.

Major brands like American Express, Disney+, Samsung, and Johnson & Johnson may have a bone to pick with Google.

-

According to research firm Adalytics, Google violated its promised standards when placing video ads on other websites about 80% of the time.

-

This includes ad placements on low-quality sites trafficking in clickbait or misinformation, as well as small, muted, and auto-play videos that appear off to the side of a page’s main content.

-

After reviewing the research, some ad buyers are asking for a refund.

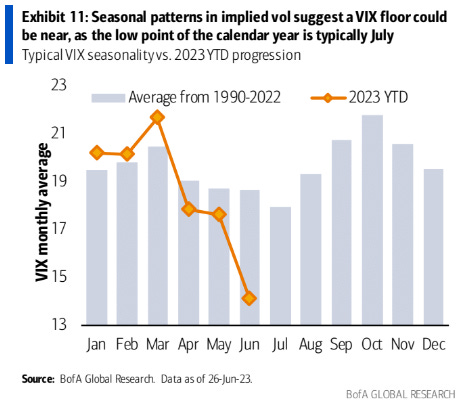

The Volatility Index (VIX) remains near its lowest levels since February 2020.

-

Fear over a drop in stock prices just ain’t what it used to be.

-

However, this month has seen more VIX call options traded than any other month on record and as BofA strategist write, “seasonality suggests a VIX floor could be near–even if the catalyst higher remains elusive”.

-

Are current levels of complacency in line for a reversal?

BofA

Energy

US stockpiles of commercial crude fell by more than expected last week.

-

It was the second straight weekly drawdown and the largest in 5 weeks.

-

Crude inventories fell by 2.4 million barrels while gasoline stocks dropped by 2.85 million barrels.

-

Cushing stocks and distillates saw builds.

Zero Hedge

Earnings

Yesterday’s highlights:

Walgreens (NASDAQ: WBA): $1.00 EPS (vs. $1.07 expected), $35.42 billion in sales (vs. $34.24B expected).

-

Walgreens missed earnings estimates for the first time since July 2020 on weak consumer spending and lower demand for Covid vaccines and testing.

-

It also lowered its full-year earnings guidance significantly, from a range of $4.45-4.65 to $4.00-4.05.

-

The company will increase its cost-cutting initiative to $4.1 billion.

What we’re watching today:

-

Micron Technology (NASDAQ: MU)

-

General Mills (NYSE: GIS)

-

Roivant Sciences (NASDAQ: ROIV)

-

Concentrix (NASDAQ: CNXC)

-

H.B. Fuller (NYSE: FUL)

-

Unifirst (NYSE: UNF)

-

Worthington Industries (NYSE: WOR)

-

Blackberry (NYSE: BB)

-

SIGNA Sports (NYSE: SSU)

Top Headlines

-

No recession: President Joe Biden believes the US economy will avoid a recession.

-

2026 recession: Analysts at Credit Suisse don’t see a recession until June 2026.

-

Chips curb: The Biden administration is considering new restrictions on the export of AI chips to China.

-

Chipmakers slump: As a result, shares of Nvidia and other chipmakers are falling.

-

USD dominance: The Official Monetary and Financial Institutions Forum predicts the US dollar will maintain its reserve currency status over the next decade.

-

Ford layoffs: Ford plans to pay off at least 1,000 salaried employees in North America to offset investments in EVs.

-

Stress test: The Fed’s bank stress test results are due this afternoon–how does it work?

-

Global liquidity: Rising stock markets around the world suggest global liquidity is once again expanding.

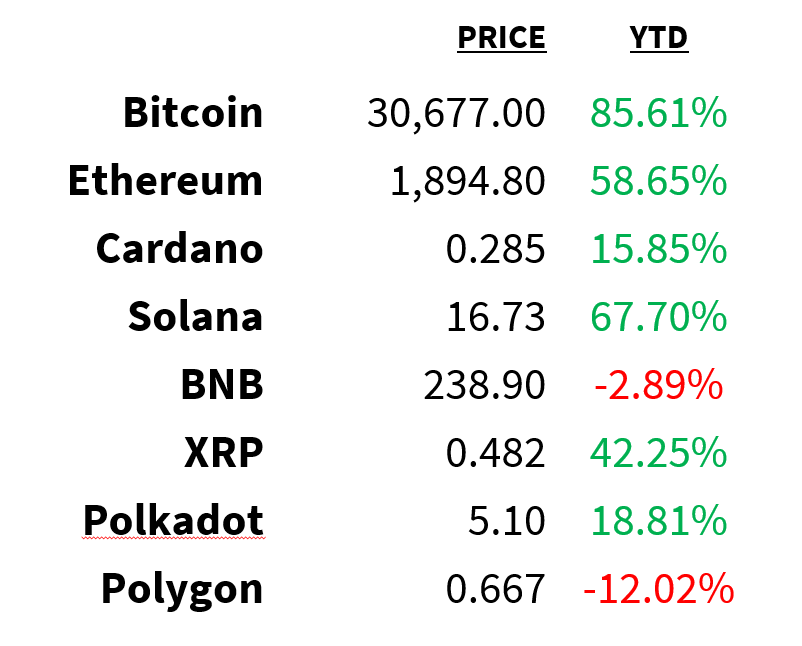

Crypto

Prices as of 4 pm EST, 6/27/23

-

ETF rush: Fidelity is expected to join others in filing for a spot Bitcoin ETF

-

BlackRock ETF: Speculation is growing that BlackRock will win approval for its Bitcoin ETF.

-

SBF rejected: A federal judge rejected Sam Bankman-Fried’s bid to dismiss most of the criminal charges against him.

-

Digital euro: The EU has published a digital euro bill that aims to provide a free digital payment system available to “everyone, everywhere, for free”.

-

Receivership: A Nevada regulator has filed to place crypto custodian Prime Trust in receivership due to an $83 million shortfall in customer funds.

Deals

-

Annuities: Brookfield has offered to buy insurer American Equity for $4.3 billion.

-

Industrial sale: Circor International will sell itself to KKR for $1.7 billion after rejecting a higher bid from Arcline Investment Management.

-

Antitrust: New merger rules requiring companies to provide more information about their transactions have the potential to delay multi-million dollar deals by months.

-

Gaming: A Sony executive testified that Microsoft’s acquisition of Activision would “degrade” the gaming experience on PlayStation.

-

Golf M&A: Under the proposed new entity with LIV Golf, PGA Tour will maintain a controlling interest on the board of directors.

Meme Of The Day

This article was submitted by an external contributor and may not represent the views and opinions of Benzinga.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Macro Economic Events News Penny Stocks Small Cap Economics Federal Reserve Markets ETFs