Shopify Teams Up With Coinbase, Stripe To Roll Out USDC Stablecoin Payments For Merchants

Tobi Lütke, CEO of Shopify Inc. (NASDAQ:SHOP), said Thursday that the firm has partnered with Coinbase Global Inc. (NASDAQ:COIN) to integrate USD Coin (CRYPTO: USDC), allowing merchants to accept payments in the world’s second-largest dollar-pegged cryptocurrency.

What Happened: In an X post, Lütke revealed that the e-commerce company will enable USDC payments on Base, an Ethereum (CRYPTO: ETH) Layer-2 blockchain incubated by Coinbase.

“Shopify will enable USDC (Stablecoins on @Base) in Checkout via Shopify Payments and Shop Pay. Early access starts today, roll out throughout the year,” Lütke said.

The CEO acknowledged that “stablecoins are a natural way to transact on the internet,” and they worked with Coinbase to develop the payment protocol powering the system.

See Also: Dogecoin Drops 6%: Why Is It Going Down?

Lütke mentioned that the integration would allow the company to offer buyer incentives like 1% cash back in the future.

“And it's all transparent to merchants, they will simply get normal local currency payouts the same as usual (unless you choose to keep it as USDC!),” he clarified.

Lütke said fintech firm Stripe helped “make this totally seamless.”

Why It Matters: This was not the first time Shopify looked into cryptocurrency payments. In 2023, it integrated Solana Pay, a payment system developed by Solana (CRYPTO: SOL), allowing payments in several stablecoins, including USDC.

The move comes amid growing acceptance of stablecoins in the financial world. Treasury Secretary Scott Bessent recently projected that dollar-pegged cryptocurrencies could reach a market capitalization of $2 trillion and beyond, as stablecoin legislation advances in the U.S. Senate.

Notably, Circle Internet Financial (NYSE:CRL), the company that issues the USDC stablecoin, opened to a bumper public listing last week. Its shares have rallied 243% from the IPO price.

Price Action: Shares of Shopify were down 2.73% in pre-market trading after closing 4.31% lower at $109.21 during Thursday’s regular trading session, according to data from Benzinga Pro.

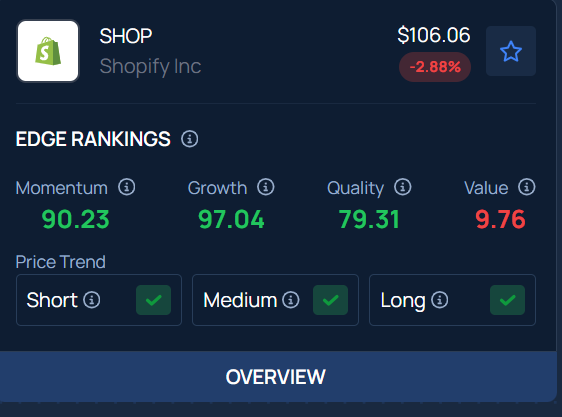

The stock demonstrated a high Momentum and Growth score as of this writing. Want to see how it stands up against other e-commerce companies? Please visit Benzinga Edge Stock Rankings.

Read Next:

Photo Courtesy: Skorzewiak on Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.