Michael Saylor's Strategy Is Amping Up Its Preferred Stock Offering From $500 Million To $2 Billion For Buying Bitcoin: Report

Michael Saylor's Bitcoin (CRYPTO: BTC) holding company, Strategy Inc. (NASDAQ:MSTR), increased the size of its latest preferred equity issuance to $2 billion from $500 million, according to a Thursday report.

What Happened: Strategy boosted its Series A Perpetual Stretch Preferred Stock offering, announced earlier this week, Bloomberg reported, citing sources familiar with the matter. The company previously disclosed a plan to issue 5 million shares.

The proceeds are meant to be channeled for general corporate purposes, including Bitcoin acquisitions.

Strategy intends to price the shares, which carry an initial dividend of 9%, at $90 each, marking a discount to the earlier face value of $100 apiece, the report said. Unlike its other preferred stock offerings, the STRC will pay cumulative dividends at a variable rate.

A preferred stock has priority over common stock in terms of dividend payments and asset distribution during liquidation.

Strategy did not immediately respond to Benzinga’s request for confirmation.

See Also: Bitcoin Could Go To $300,000 Before ‘Great Depression’ Crisis, Traders Argue

Why It Matters: Strategy has front-run Bitcoin’s corporate adoption, building its reserve with proceeds from common stock, preferred stock, and convertible bond issuances. The firm held a stash of more than 607,770 BTC, worth over $70 billion as of this writing, according to bitcointreasuries.net, cornering over 3% of the total circulating supply.

The preferred stock strategy capitalizes on what Saylor has described as a "quadratically reflexive, engineered instrument" that allows Strategy to issue shares at premiums to Bitcoin's value, effectively acquiring BTC at discounts.

Price Action: At the time of writing, BTC was exchanging hands at $115,317, down 2.71% in the last 24 hours, according to data from Benzinga Pro.

Shares of Strategy fell 0.44% in after-hours trading after closing 0.55% higher at $414.92 during Thursday's regular trading session, according to data from Benzinga Pro. Year-to-date, the stock has gained 43.26%.

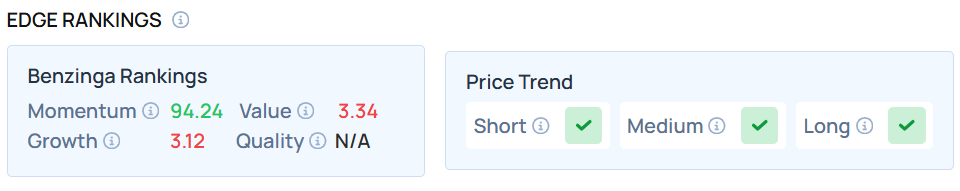

MSTR recorded an impressive Momentum score as of this writing. If you are looking to set aside similar high-momentum stocks for your portfolio, go to Benzinga Edge Stock Rankings for assistance.

Photo courtesy: PJ McDonnell / Shutterstock.com

Read Next:

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Cryptocurrency