These Analysts Boost Their Forecasts On UiPath After Upbeat Q1 Results

UiPath Inc. (NYSE:PATH) reported better-than-expected first-quarter financial results and raised its FY26 guidance on Thursday.

UiPath reported quarterly earnings of 11 cents per share which beat the analyst consensus estimate of 10 cents per share. The company reported quarterly sales of $356.62 million which beat the analyst consensus estimate of $332.87 million.

"This was a milestone quarter for UiPath, marked by the launch of our agentic automation platform, a meaningful step forward in our product evolution. We're encouraged by the early response from customers, partners, and the broader ecosystem, which underscores the growing interest in agentic automation as a key part of the enterprise automation journey," said Daniel Dines, founder and CEO of UiPath.

UiPath expects second-quarter revenue to be between $345 million and $350 million versus estimates of $333.12 million, according to Benzinga Pro. The company also raised its fiscal 2026 forecast from a range of $1.52 billion to $1.53 billion to a new range of $1.549 billion to $1.554 billion versus estimates of $1.53 billion.

UiPath shares gained 0.3% to trade at $12.98 on Friday.

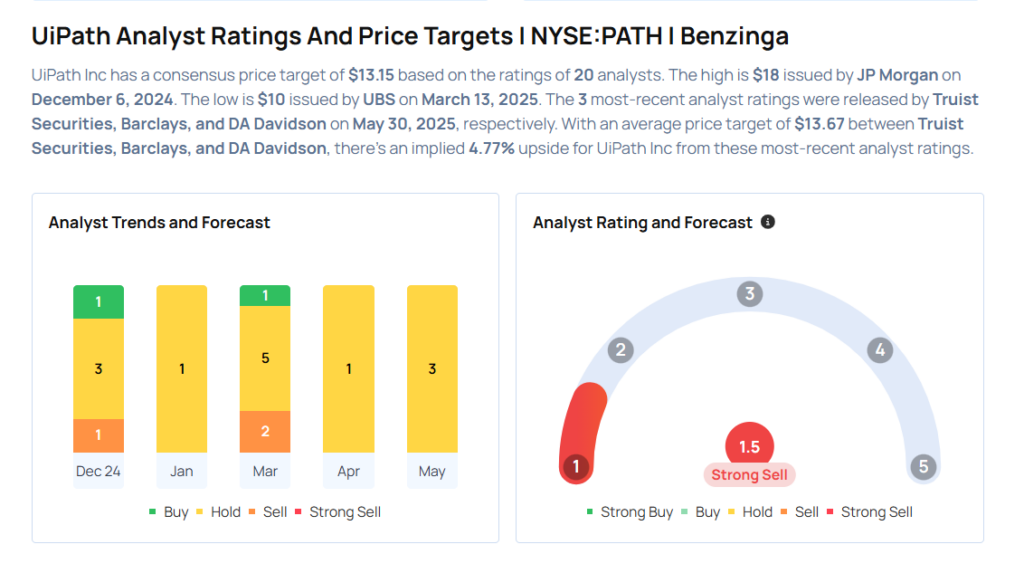

These analysts made changes to their price targets on UiPath following earnings announcement.

- Wells Fargo analyst Michael Turrin maintained UiPath with an Equal-Weight rating and raised the price target from $11 to $12.

- RBC Capital analyst Matthew Hedberg maintained the stock with a Sector Perform and raised the price target from $13 to $15.

- Scotiabank analyst Nick Altmann maintained UiPath with a Sector Perform and raised the price target from $12 to $13.

- DA Davidson analyst Gil Luria maintained the stock with a Neutral and raised the price target from $11 to $14.

- Barclays analyst Raimo Lenschow maintained UiPath with an Equal-Weight rating and raised the price target from $12 to $14.

- Truist Securities analyst Terry Tillman maintained the stock with a Hold and raised the price target from $12 to $13.

Considering buying PATH stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Latest Ratings for PATH

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jan 2022 | Macquarie | Upgrades | Neutral | Outperform |

| Jan 2022 | Macquarie | Upgrades | Neutral | Outperform |

| Jan 2022 | Oppenheimer | Upgrades | Perform | Outperform |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: PT ChangesEarnings News Price Target Markets Analyst Ratings Trading Ideas