Coursera Analysts Boost Their Forecasts After Upbeat Q2 Results

Coursera, Inc. (NYSE:COUR) posted better-than-expected second-quarter results after Thursday’s closing bell.

Coursera reported quarterly earnings of 12 cents per share, which beat the analyst consensus estimate of nine cents. Quarterly revenue clocked in at $187.1 million, which beat the Street estimate of $180.48 million.

"Coursera's market opportunity continues to expand with the global demand to embrace new technology and skills. This quarter, we attracted more than seven million new learners looking to master emerging skills that can advance their careers," said Coursera CEO Greg Hart.

Coursera raised its full year 2025 revenue outlook by $17 million to a range of $738 to $746 million.

Coursera shares gained 1.3% to close at $9.08 on Thursday.

These analysts made changes to their price targets on Coursera following earnings announcement.

- Needham analyst Ryan MacDonald maintained Coursera with a Buy and raised the price target from $11 to $14.

- B of A Securities analyst Nafeesa Gupta upgraded Coursera from Underperform to Neutral and raised the price target from $7 to $12.

- Telsey Advisory Group analyst Sarang Vora maintained the stock with an Outperform rating and raised the price target from $12 to $14.

- Keybanc analyst Bradley Thomas maintained Coursera with an Overweight rating and boosted the price target from $11 to $12.

- Morgan Stanley analyst Josh Baer maintained the stock with an Equal-Weight rating and raised the price target from $11 to $12.

- Cantor Fitzgerald analyst Yi Fu Lee maintained the stock with an Overweight rating and lifted the price target from $10 to $13.

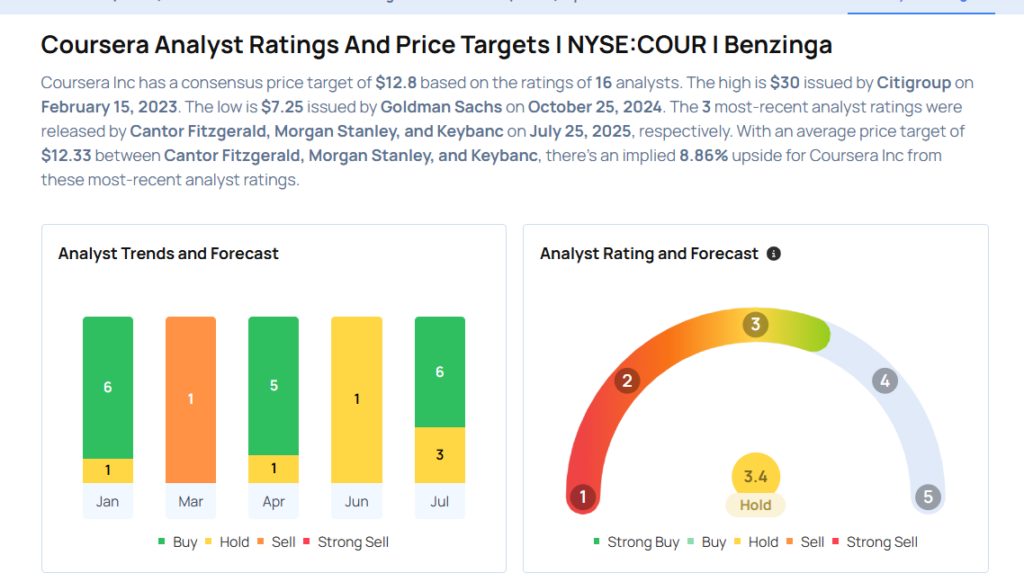

Considering buying COUR stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Latest Ratings for COUR

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Raymond James | Maintains | Outperform | |

| Feb 2022 | Telsey Advisory Group | Maintains | Outperform | |

| Feb 2022 | Keybanc | Maintains | Overweight |

Posted-In: PT ChangesEarnings News Price Target Markets Analyst Ratings Trading Ideas