Goosehead Insurance Analysts Slash Their Forecasts After Q2 Results

Goosehead Insurance, Inc (NASDAQ:GSHD) reported mixed results for the second quarter on Wednesday.

The company posted quarterly earnings of 49 cents per share which missed the analyst consensus estimate of 50 cents per share. The company reported quarterly sales of $94.03 million which beat the analyst consensus estimate of $93.85 million.

“We delivered another strong quarter result while making substantial investments in people and technology that are laying the foundation for significant transformation, efficiency and future growth,” said Mark Miller, President and CEO. “In the second quarter we delivered premium growth of 18%, total revenue growth of 20%, core revenue growth of 18%, net income decline of 24% and adjusted EBITDA growth of 18% with net income margin of 9% and adjusted EBITDA margin of 31%. We are adding productive capacity to our corporate and franchise networks in varied geographies, building new go-to-market motions through enterprise sales and partnerships, and developing new technologies to engage with clients and partners in the ways they find most optimal – be it through agent interaction or digitally direct. We continue our work to become the largest distributor of personal lines in our founder’s life-time and I am extremely proud to be part of this incredible team executing towards that objective.”

Goosehead Insurance affirmed FY2025 sales guidance of $350.00 million to $385.00 million.

Goosehead Insurance shares fell 15.5% to trade at $87.39 on Thursday.

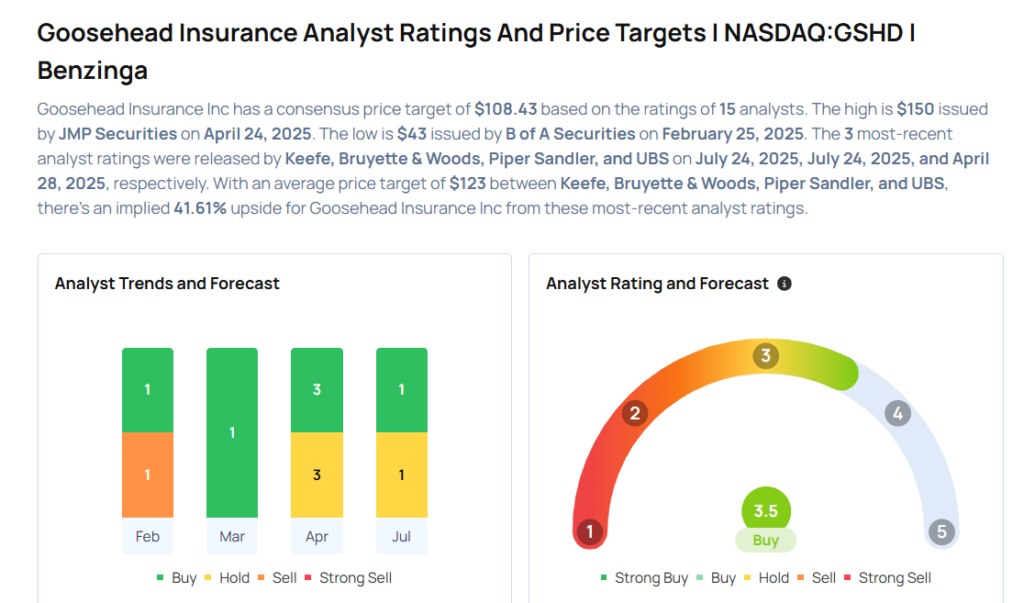

These analysts made changes to their price targets on Goosehead Insurance following earnings announcement.

- Piper Sandler analyst Paul Newsome downgraded Goosehead Insurance from Overweight to Neutral and lowered the price target from $122 to $109.

- Keefe, Bruyette & Woods analyst Tommy McJoynt maintained the stock with an Outperform rating and cut the price target from $130 to $120.

Considering buying GSHD stock? Here’s what analysts think:

Photo via Shutterstock

Latest Ratings for GSHD

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Piper Sandler | Maintains | Overweight | |

| Feb 2022 | Truist Securities | Maintains | Hold | |

| Jan 2022 | RBC Capital | Maintains | Outperform |

Posted-In: PT ChangesEarnings News Price Target Markets Analyst Ratings Trading Ideas