Preferred Bank Analysts Boost Their Forecasts After Better-Than-Expected Q2 Earnings

Preferred Bank (NASDAQ:PFBC) reported better-than-expected earnings for the second quarter on Monday.

The company posted quarterly earnings of $2.52 per share which beat the analyst consensus estimate of $2.42 per share. The company reported quarterly sales of $66.87 million which beat the analyst consensus estimate of $66.72 million.

Li Yu, Chairman and CEO, commented, “We are pleased to report our results for the second quarter of 2025. We recorded net income of $32.8 million or $2.52 per fully diluted share. This quarter we had an increase in our loan portfolio of 1.8% (linked quarter), however, deposits only increased slightly. The Bank’s net interest margin improved to 3.85%. Last quarter we reported a net interest margin of 3.75% which was negatively impacted by an outsized interest reversal.”

Preferred Bank shares gained 0.6% to trade at $97.60 on Tuesday.

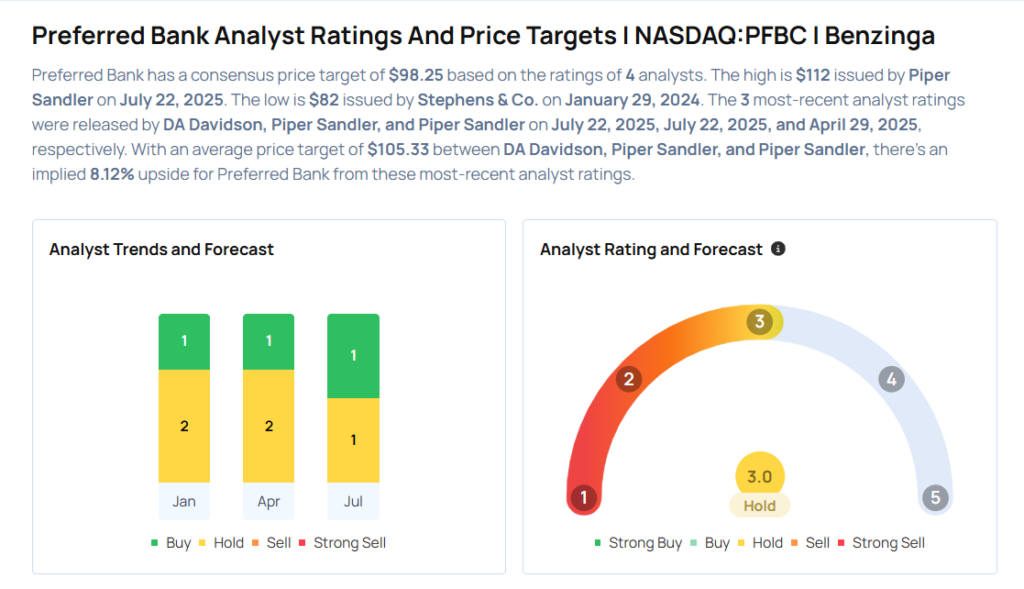

These analysts made changes to their price targets on Preferred Bank following earnings announcement.

- Piper Sandler analyst Matthew Clark maintained Preferred Bank with an Overweight rating and raised the price target from $96 to $112.

- DA Davidson analyst Gary Tenner maintained the stock with a Neutral and raised the price target from $90 to $108.

Considering buying PFBC stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Latest Ratings for PFBC

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Janney Montgomery Scott | Upgrades | Neutral | Buy |

| Jan 2022 | Piper Sandler | Maintains | Overweight | |

| Jan 2022 | B. Riley Securities | Maintains | Buy |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: PT ChangesEarnings News Price Target Markets Analyst Ratings Trading Ideas