These Analysts Cut Their Forecasts On Conagra Brands After Weak Q4 Earnings

ConAgra Brands, Inc. (NYSE:CAG) posted disappointing Q4 results and issued a cautious outlook for fiscal 2026 on Thursday.

The company reported adjusted earnings per share of 56 cents, missing the analyst consensus estimate of 58 cents. Quarterly net sales of $2.78 billion, missed the Street view of $2.83 billion.

"While the second half was impacted by higher than expected inflation, foreign exchange headwinds, and supply constraints, our long-term value creation strategy remains unchanged," said Sean Connolly, president and chief executive officer of Conagra Brands. "In fiscal 2026, we expect elevated inflation and macroeconomic uncertainty to persist but remain focused on proactively managing the business by investing in our high-potential frozen and snacks domains, prioritizing volume strength, and further enhancing supply chain resiliency while continuing disciplined cost management and focus on cash flow."

ConAgra Brands shares fell 0.5% to close at $19.40 on Friday.

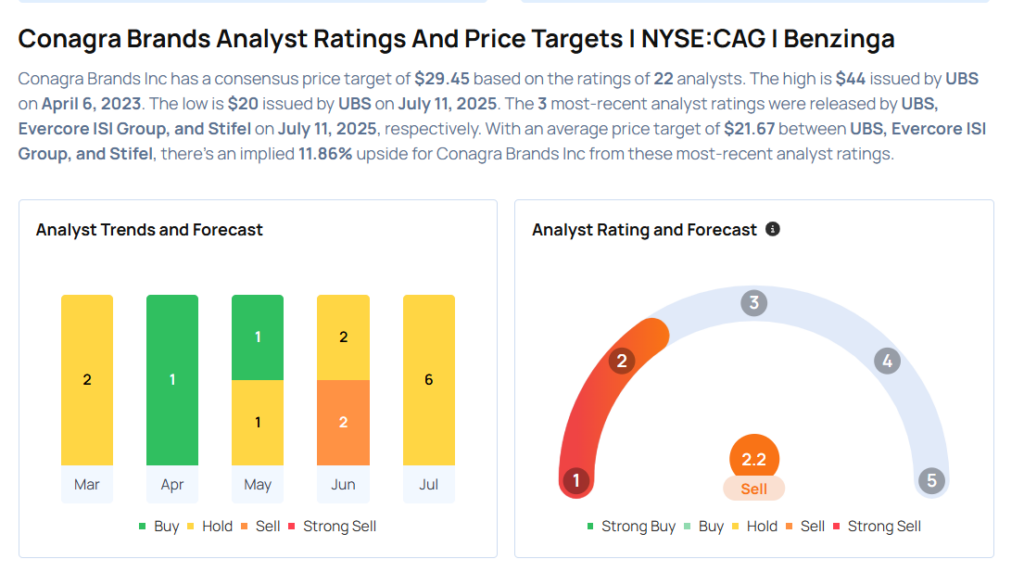

These analysts made changes to their price targets on ConAgra Brands following earnings announcement.

- Morgan Stanley analyst Megan Alexander maintained Conagra Brands with an Equal-Weight rating and lowered the price target from $22 to $20.

- RBC Capital analyst Nik Modi maintained the stock with a Sector Perform and lowered the price target from $25 to $22.

- Stifel analyst Matthew Smith maintained Conagra Brands with a Hold and lowered the price target from $26 to $21.

- Evercore ISI Group analyst David Palmer maintained the stock with an In-Line rating and cut the price target from $26 to $24.

- UBS analyst Bryan Adams maintained Conagra Brands with a Neutral and lowered the price target from $21 to $20.

Considering buying CAG stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Latest Ratings for CAG

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jan 2022 | Morgan Stanley | Maintains | Equal-Weight | |

| Oct 2021 | JP Morgan | Downgrades | Overweight | Neutral |

| Sep 2021 | Credit Suisse | Upgrades | Underperform | Neutral |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: PT ChangesEarnings News Price Target Markets Analyst Ratings Trading Ideas