BlackBerry Analysts Boost Their Forecasts After Upbeat Earnings

BlackBerry Limited (NYSE:BB) posted better-than-expected first-quarter results after Tuesday’s closing bell.

BlackBerry reported quarterly earnings of two cents per share, which beat the analyst consensus estimate of zero cents. Quarterly revenue of $121.7 million beat the Street estimate of $112.18 million.

"BlackBerry made a strong start to the new fiscal year, building on the solid foundation we as a company have laid over the past year," said John J. Giamatteo, CEO of BlackBerry. "Both our QNX and Secure Communications divisions continue to execute effectively against their strategies, beating both top line and profitability expectations."

BlackBerry affirmed its fiscal 2026 adjusted EPS guidance of a range of eight cents to 10 cents. The company raised its fiscal 2026 revenue guidance from a range of $504 million to $534 million to a new range of between $508 million and $538 million, versus the $513.51 million estimate.

BlackBerry shares jumped 14.7% to trade at $4.9649 on Wednesday.

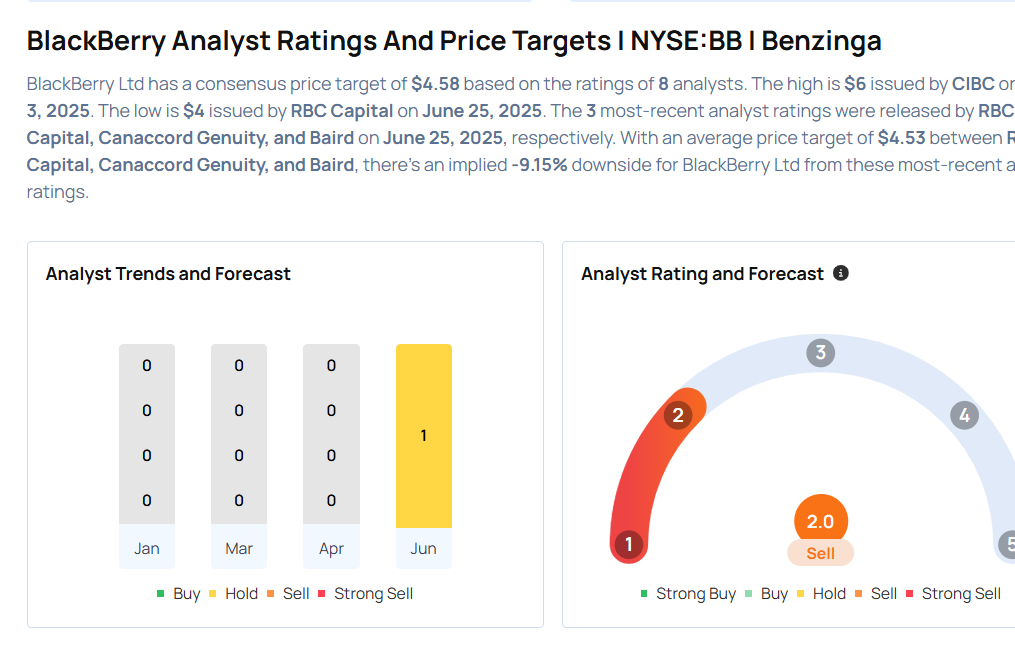

These analysts made changes to their price targets on BlackBerry following earnings announcement.

- Baird analyst Luke Junk maintained BlackBerry with a Neutral and raised the price target from $4 to $5.

- Canaccord Genuity analyst Kingsley Crane maintained the stock with a Hold and raised the price target from $4.25 to $4.6.

- RBC Capital analyst Paul Treiber maintained BlackBerry with a Sector Perform and raised the price target from $3.75 to $4.

Considering buying BB stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Latest Ratings for BB

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Aug 2021 | Canaccord Genuity | Upgrades | Sell | Hold |

| Jun 2021 | TD Securities | Downgrades | Hold | Reduce |

| Jun 2021 | CIBC | Downgrades | Neutral | Underperform |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: PT ChangesEarnings News Price Target Markets Analyst Ratings Trading Ideas