These Analysts Increase Their Forecasts On CarMax After Upbeat Q1 Results

CarMax, Inc. (NYSE:KMX) reported better-than-expected first-quarter financial results on Friday.

The Richmond, Virginia-based used car retailer registered earnings per share of $1.38, beating the analyst consensus estimate of $1.21. Quarterly sales of $7.55 billion outpaced the analyst consensus estimate of $7.47 billion.

In the quarter under review, the firm opened two new stand-alone reconditioning/auction centers. The centers are located in El Mirage, Arizona, supporting the Phoenix metro market, and Midlothian, Texas, supporting the Dallas metro market.

“We delivered our fourth consecutive quarter of positive retail comps and double-digit year-over-year earnings per share growth. These results highlight the strength of our earnings growth model, which is underpinned by our best-in-class omni-channel experience, the diversity of our business, and our sharp focus on execution,” said Bill Nash, president and chief executive officer. “Our associates, stores, technology and digital capabilities, all seamlessly tied together, enable us to provide the most customer-centric car buying and selling experience. This is a key differentiator in a very large and fragmented market that positions us to continue to drive sales, gain market share, and deliver significant year-over-year earnings growth for years to come.”

CarMax shares fell 4.8% to trade at $65.27 on Monday.

These analysts made changes to their price targets on CarMax following earnings announcement.

- Truist Securities analyst Scot Ciccarelli maintained CarMax with a Hold and raised the price target from $72 to $74.

- RBC Capital analyst Steven Shemesh maintained the stock with an Outperform rating and raised the price target from $80 to $81.

- Needham analyst Chris Pierce reiterated CarMax with a Buy and maintained a $92 price target.

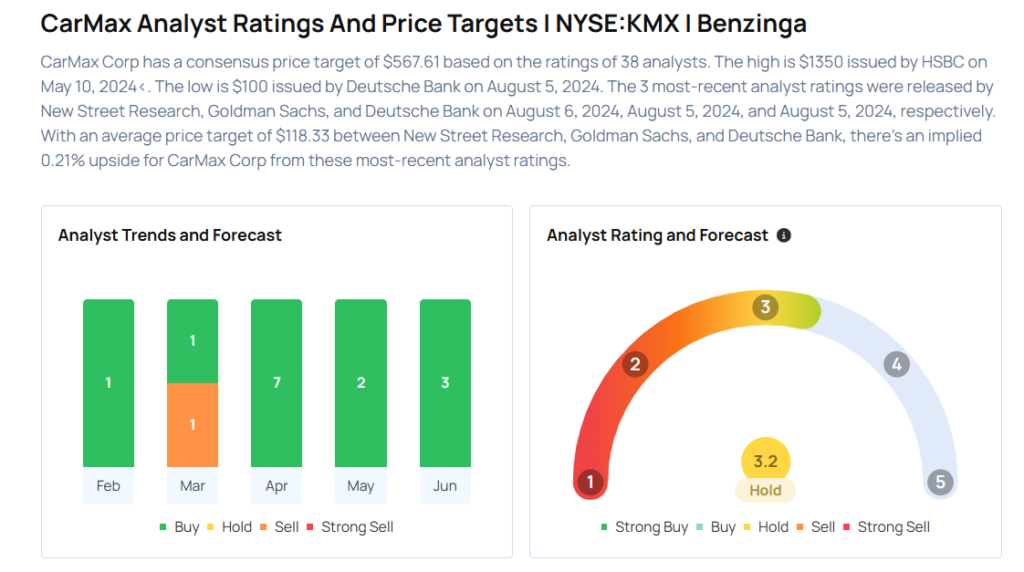

Considering buying KMX stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Latest Ratings for KMX

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Evercore ISI Group | Downgrades | Outperform | In-Line |

| Jan 2022 | Seaport Global | Upgrades | Neutral | Buy |

| Dec 2021 | RBC Capital | Maintains | Outperform |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: PT ChangesEarnings News Price Target Markets Analyst Ratings Trading Ideas