These Analysts Revise Their Forecasts On Sage Therapeutics Following Acquisition News

Supernus Pharmaceuticals, Inc. (NASDAQ:SUPN) on Monday agreed to acquire Sage Therapeutics, Inc. (NASDAQ:SAGE) for $12.00 per share in cash, or an aggregate of up to approximately $795 million.

The deal consideration includes $8.50 per share in cash (or an aggregate of approximately $561 million) plus one non-tradable contingent value right (CVR) collectively worth up to $3.50 per share in cash (or an aggregate of approximately $234 million).

"This acquisition represents a major step in bolstering our future growth. It augments our growth profile by adding a significant fourth growth product to our portfolio and further diversifies our sources of future growth. Zurzuvae aligns with our focus of acquiring novel value-enhancing and clinically differentiated medicines to treat CNS conditions," said Jack Khattar, president and CEO of Supernus Pharmaceuticals.

Sage Therapeutics shares gained 0.4% to trade at $9.11 on Tuesday.

These analysts made changes to their price targets on Sage Therapeutics following acquisition announcement.

- Canaccord Genuity analyst Sumant Kulkarni maintained Sage Therapeutics with a Hold and raised the price target from $8 to $8.5.

- Truist Securities analyst Joon Lee maintained the stock with a Hold and raised the price target from $8 to $9.

- Piper Sandler analyst David Amsellem downgraded Sage Therapeutics from Overweight to Neutral and lowered the price target from $9 to $8.5.

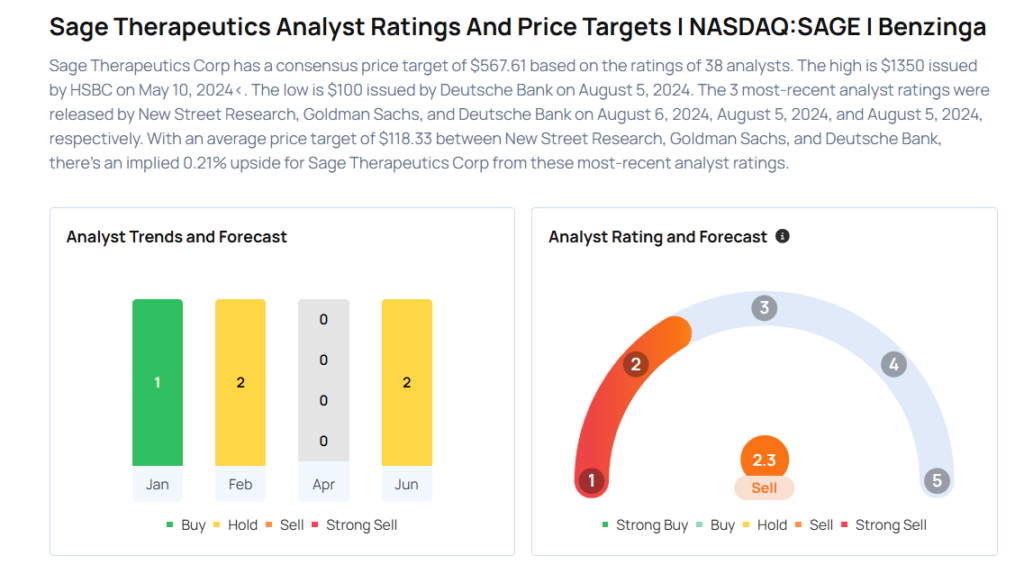

Considering buying SAGE stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Latest Ratings for SUPN

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Apr 2021 | Jefferies | Upgrades | Hold | Buy |

| Jun 2020 | Piper Sandler | Upgrades | Neutral | Overweight |

| Jun 2020 | Jefferies | Reinstates | Hold |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: PT ChangesM&A News Price Target Markets Analyst Ratings Trading Ideas