Top Wall Street Forecasters Revamp Core & Main Expectations Ahead Of Q1 Earnings

Core & Main, Inc. (NYSE:CNM) will release its first-quarter financial results before the opening bell on Tuesday, June 10.

Analysts expect the Saint Louis, Missouri-based company to report quarterly earnings at 54 cents per share, up from 49 cents per share in the year-ago period. Core & Main projects quarterly revenue of $1.85 billion, compared to $1.74 billion a year earlier, according to data from Benzinga Pro.

On March 25, Core & Main reported fourth-quarter earnings of 33 cents per share, missing the consensus of 36 cents.

Core & Main shares fell 0.6% to close at $59.33 on Monday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

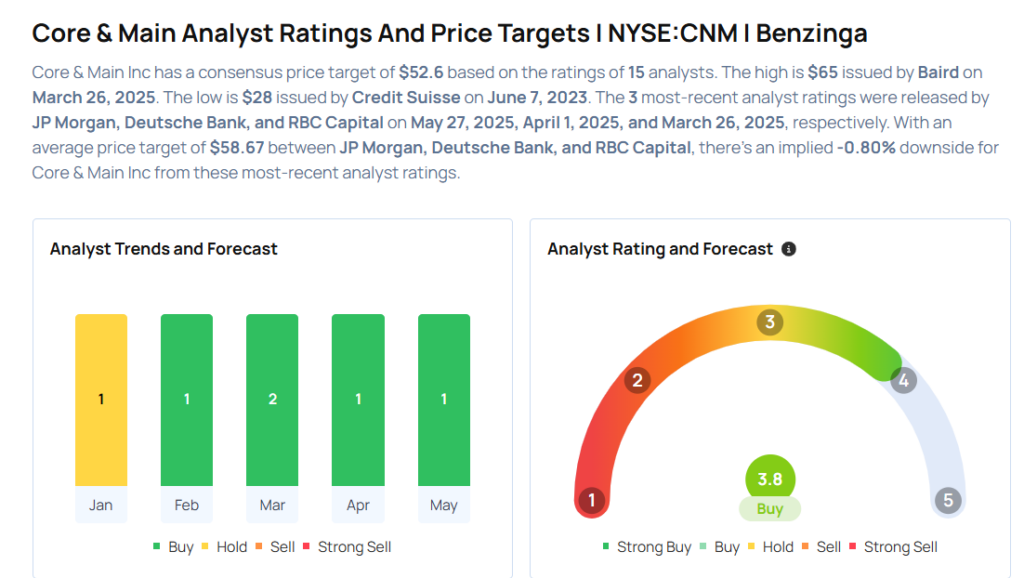

- JP Morgan analyst Stephen Tusa maintained an Overweight rating and increased the price target from $54 to $56 on May 27, 2025. This analyst has an accuracy rate of 66%.

- RBC Capital analyst Mike Dahl maintained an Outperform rating and cut the price target from $62 to $60 on March 26, 2025. This analyst has an accuracy rate of 73%.

- Baird analyst David Manthey maintained an Outperform rating and lowered the price target from $66 to $65 on March 26, 2025. This analyst has an accuracy rate of 76%.

- Wells Fargo analyst Sam Reid maintained an Overweight rating and raised the price target from $62 to $65 on Feb. 4, 2025. This analyst has an accuracy rate of 64%.

- Citigroup analyst Anthony Pettinari maintained a Neutral rating and raised the price target from $43 to $56 on Jan. 6, 2025. This analyst has an accuracy rate of 76%

Considering buying CNM stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Latest Ratings for CNM

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | B of A Securities | Downgrades | Neutral | Underperform |

| Jan 2022 | RBC Capital | Upgrades | Sector Perform | Outperform |

| Dec 2021 | Barclays | Maintains | Equal-Weight |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Expert IdeasEarnings News Price Target Pre-Market Outlook Markets Analyst Ratings Trading Ideas