Wall Street's Most Accurate Analysts Give Their Take On 3 Energy Stocks With Over 5% Dividend Yields

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the energy sector.

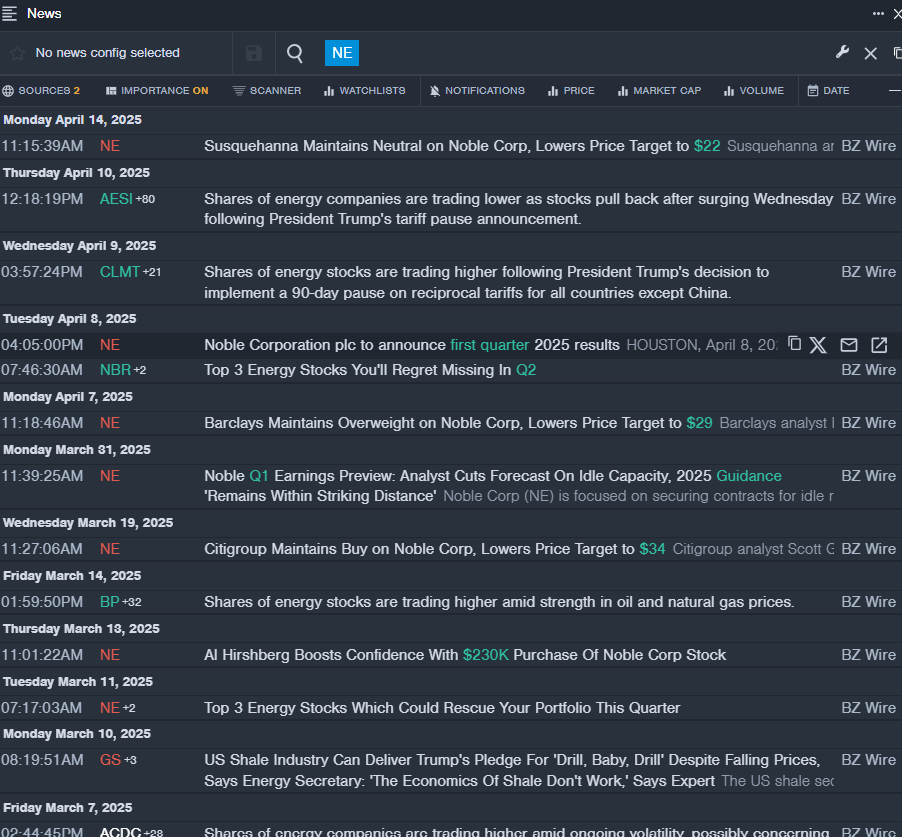

Noble Corporation plc (NYSE:NE)

- Dividend Yield: 10.22%

- Citigroup analyst Scott Gruber maintained a Buy rating and cut the price target from $40 to $34 on March 19, 2025. This analyst has an accuracy rate of 61%.

- Evercore ISI Group analyst James West downgraded the stock from Outperform to In-Line and cut the price target from $64 to $41 on Jan. 15, 2025. This analyst has an accuracy rate of 61%.

- Recent News: Noble will report financial results for the first quarter on Monday April 28, after the U.S. market close.

- Benzinga Pro’s real-time newsfeed alerted to latest NE news.

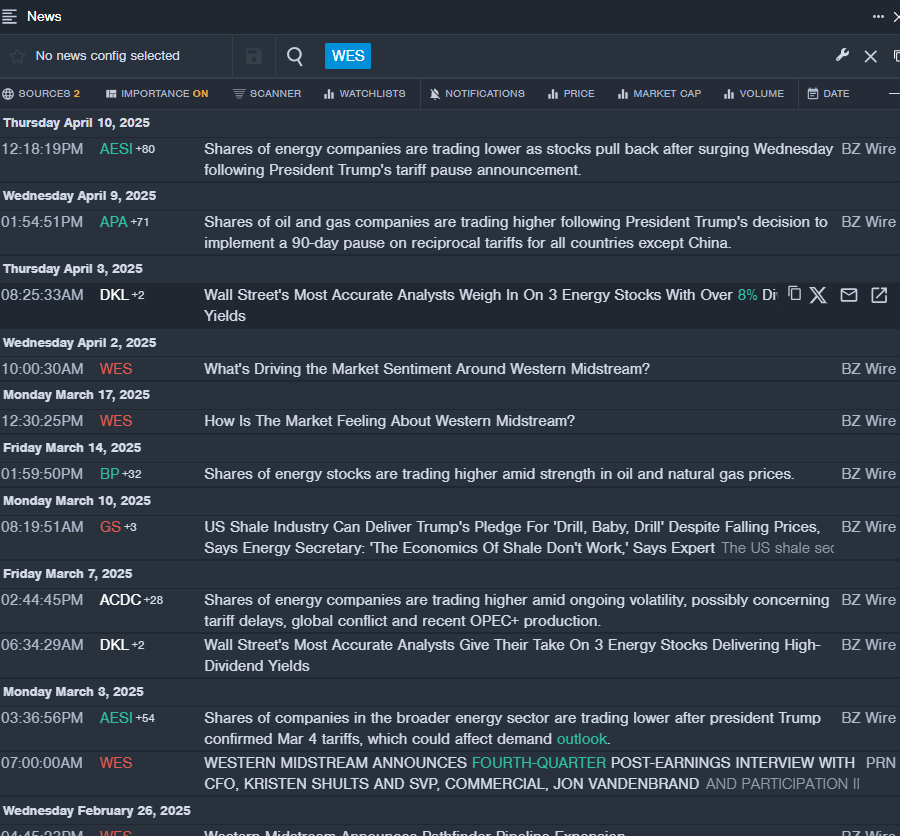

Western Midstream Partners, LP (NYSE:WES)

- Dividend Yield: 9.08%

- UBS analyst Shneur Gershuni maintained a Neutral rating and cut the price target from $40 to $37 on Nov. 15, 2024. This analyst has an accuracy rate of 80%.

- Morgan Stanley analyst Robert Kad downgraded the stock from Equal-Weight to Underweight and slashed the price target from $42 to $40 on Oct. 25, 2024. This analyst has an accuracy rate of 74%.

- Recent News: On Feb. 26, Western Midstream posted weak quarterly earnings.

- Benzinga Pro's real-time newsfeed alerted to latest WES news

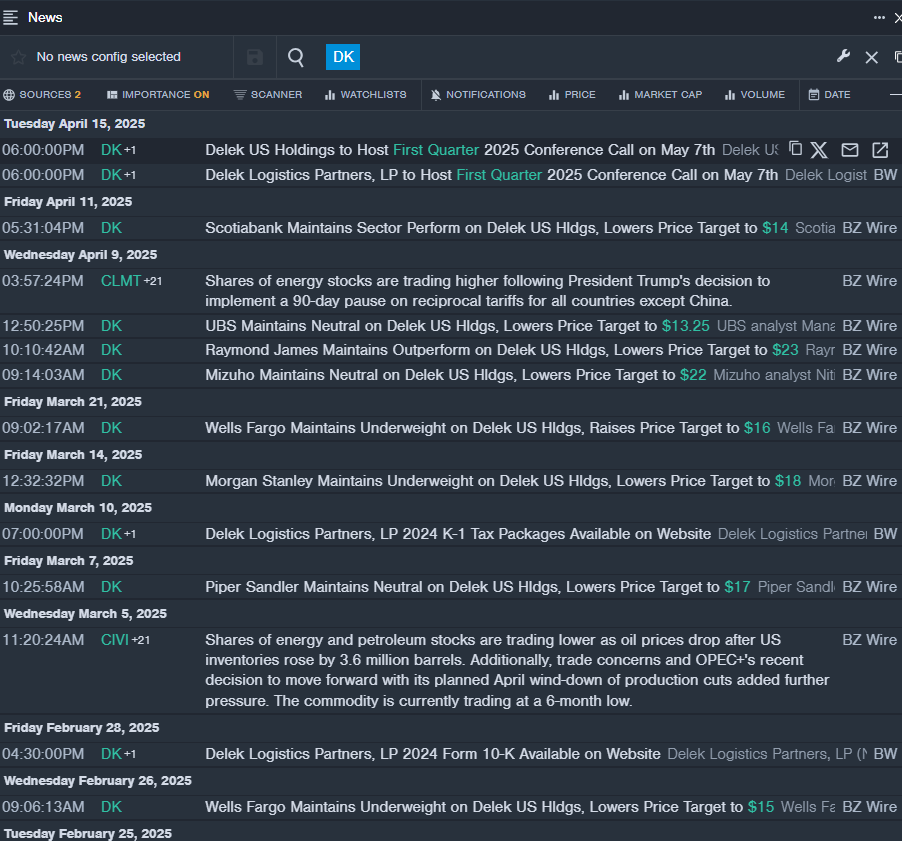

Delek US Holdings, Inc. (NYSE:DK)

- Dividend Yield: 8.40%

- Raymond James analyst Justin Jenkins maintained an Outperform rating and cut the price target from $24 to $23 on April 9, 2025. This analyst has an accuracy rate of 77%.

- Wells Fargo analyst Roger Read maintained an Underweight rating and raised the price target from $15 to $16 on March 21, 2025. This analyst has an accuracy rate of 62%.

- Recent News: Delek US Holdings will release first quarter results before the US stock market opens on Wednesday, May 7.

- Benzinga Pro’s real-time newsfeed alerted to latest DK news

Read More:

Photo via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: dividend yieldNews Dividends Price Target Pre-Market Outlook Markets Analyst Ratings Trading Ideas