Strong Jobs Report 'On A Day When Good News Doesn't Matter,' Economist Says

While the world focused on escalating global trade tensions, the Bureau of Labor Statistics reported Friday that nonfarm payrolls surged by 228,000 in March, far better than economists’ forecasts of 135,000. Economists are weighing in on the positive jobs report as fears of a global trade war roil the markets.

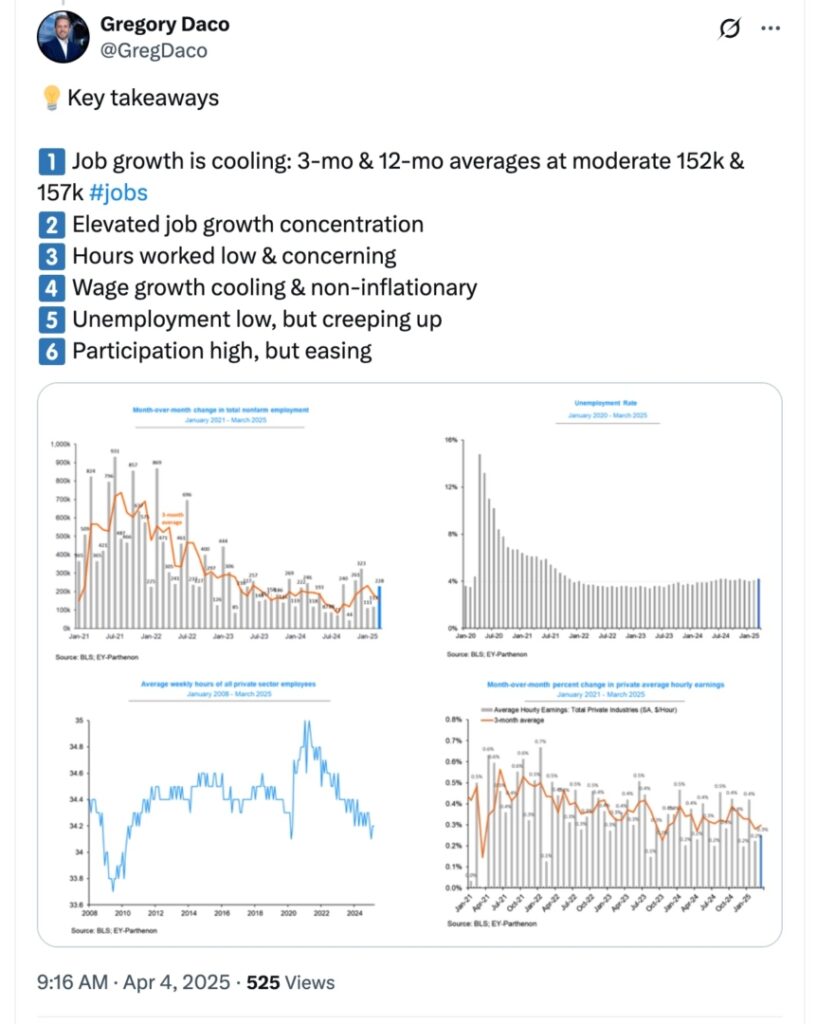

Gregory Daco, chief economist for EY, referred to the jobs report as "reassuring" in a post on X but also noted several metrics appear to be slowing, including wage growth and participation.

Daco also said in an interview with Yahoo Finance on Friday morning that this may be the last strong report for some time, as the country sits “on the eve of what may be a significant economic slowdown resulting from the tariffs.”

Read Next: Trump Slaps 25% Tariffs On Autos: What It Means For Your Next Car Purchase

Joseph Brusuelas, chief economist for RSM, also predicted future turmoil in the job market in comments to the Wall Street Journal.

"The primary takeaway for the March jobs report is that it represents the calm before the storm," said Brusuelas. "The new tariff regime is going to dampen hiring and send unemployment higher in the coming months." Brusuelas added.

Chris Zaccarelli, chief investment officer for Northlight Asset Management, said that the positive jobs report comes "on a day when good news doesn't matter," adding that markets are "focused squarely on tariffs and trade wars as the US plays chicken with the rest of the world, potentially beginning a downward spiral into a worldwide recession."

President Donald Trump, seemingly unfazed by the market rout, touted the better-than-expected March jobs report in a post on Truth Social.

"GREAT JOB NUMBERS, FAR BETTER THAN EXPECTED. IT'S ALREADY WORKING. HANG TOUGH, WE CAN'T LOSE!!!" Trump wrote.

Markets React: All three major U.S. indexes were deeply red on Friday morning with the SPDR S&P 500 ETF Trust (NYSE:SPY), tracking the S&P 500, down 3.2% at $519.50 and the Invesco QQQ Trust (NASDAQ:QQQ), tracking the Nasdaq 100 index, down 3.55% at $434.65.

Read Next:

Image: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Chris ZaccarelliAnalyst Color News Broad U.S. Equity ETFs Econ #s Economics Movers ETFs