US Steel Stock Surges Forming Golden Cross, Does Billionaire Investment In X Signal More Upside?

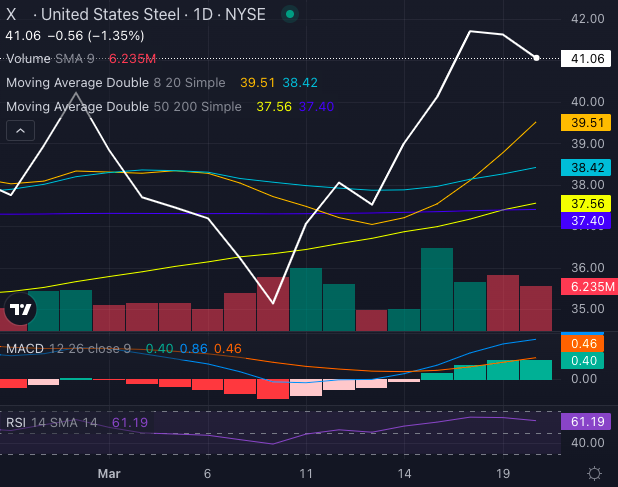

United States Steel Corp (NYSE:X) is flashing bullish signals, riding an 8.35% gain over the past five days and forming a Golden Cross, a technical indicator often linked to continued upside.

Shares now sit above their key moving averages, suggesting strong momentum as Wall Street weighs the company's earnings outlook and merger drama.

Chart created using Benzinga Pro

X Stock: Golden Cross Fuels Bullish Momentum

X stock has decisively broken above its short- and long-term moving averages, reinforcing a bullish trend:

- The stock trades at $41.06, well above its eight-day SMA (simple moving average) of $39.51, 20-day SMA of $38.42 and 50-day SMA of $37.56 – all flashing bullish signals.

- Even its 200-day SMA of $37.40 is far behind, underscoring solid technical strength.

With this momentum, traders are watching whether X can break through resistance and extend gains.

Read Also: US Steel Faces Q1 Pressures, But Eyes Long-Term Gains From BR2 & Nippon Partnership

JPMorgan: Solid Foundation, But Merger Uncertainty Lingers

JPMorgan analyst Bill Peterson remains Overweight on X stock, with a $43 price target. The firm's Q1 EBITDA guidance of $125 million was in line with estimates and stronger than mini-mill rivals like Steel Dynamics Inc (NASDAQ:STLD) and Nucor Corp (NYSE:NUE).

However, challenges remain, including lagged pricing impacts, European demand weakness and start-up costs for its BRS2 expansion.

While the Nippon Steel Corp (OTCPK: NISTF) merger remains uncertain, Peterson sees US Steel's valuation supported above $40 per share, suggesting any regulatory setback could create a dip-buying opportunity.

Billionaire Druckenmiller Bets Big On X Stock

Adding intrigue, hedge fund titan Stanley Druckenmiller has more than doubled his stake in US Steel, increasing his position by 143% last quarter. His bet comes as President Donald Trump hints at supporting the blocked Nippon deal—potentially reopening the door for a takeover.

With a Golden Cross, strong buying momentum, and a billionaire-backed vote of confidence, US Steel's next move could be explosive. Will the stock break out, or will regulatory uncertainty put a lid on the rally?

Read Next:

Photo: Shutterstock

Latest Ratings for X

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Morgan Stanley | Upgrades | Underweight | Equal-Weight |

| Jan 2022 | Wolfe Research | Downgrades | Peer Perform | Underperform |

| Nov 2021 | Wolfe Research | Initiates Coverage On | Peer Perform |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Analyst Color Long Ideas M&A Technicals Commodities Top Stories Signals Markets