Nvidia Stock, Semiconductor Sector Split Between AI Winners And Losers: Analyst Says 'Stick With AI First And Foremost'

With NVIDIA Corporation (NASDAQ:NVDA) earnings in focus this week, analysts highlight key trends including the rise of artificial intelligence, strong demand from China, and geopolitical restrictions as crucial drivers for the semiconductor industry.

Nvidia Earnings: Analysts expect Nvidia to report revenue of $28.7 billion for the second quarter, compared to $13.5 billion reported in last year's second quarter, according to data from Benzinga Pro.

The company has beaten revenue estimates in eight straight quarters and nine of the last 10 quarters.

Analysts see Nvidia reporting second-quarter earnings per share of 64 cents compared to 27 cents in last year's second quarter. The company has beat earnings estimates from analysts in six straight quarters and eight of the last 10 quarters.

Cantor Fitzgerald analyst C.J. Muse calls Nvidia one of the top picks for the second half of 2024 ahead of the earnings report.

"Stick with AI first and foremost," Muse said of the semiconductor sector.

Muse said when it comes to semiconductor companies and AI, "you either have it or you don't."

"2Q continued to show a divergence between the haves and have-nots, with anything AI-related thriving, while other areas remain in the cyclical doldrums."

The analyst sees China demand showing relative strength, which could be a positive for Nvidia and the sector. Geopolitical tentions that are at the forefront of investor concerns appear to have a minimal impact on the companies based on results and guidance, the analyst said.

Muse said the delay of Nvidia's Blackwell is a real concern, but not on the level some are expecting.

"A 1-2 month delay makes little to no difference to our thesis on the name. Demand remains robust and supply remains tight."

Muse said the Blackwell concerns being overdone makes Nvidia's valuation "too cheap to ignore."

Other Semiconductor Picks: Muse highlights Nvidia as a top winner in the semiconductor sector for the second half of 2024 alongside Broadcom Inc (NASDAQ:AVGO), Micron Technology (NASDAQ:MU), Western Digital Corporation (NASDAQ:WDC), NXP Semiconductors (NASDAQ:NXPI), ASML Holdings (NASDAQ:ASML) and Teradyne Inc (NASDAQ:TER) as top picks.

Broadcom, Micron, Teradyne and Marvell Technology (NASDAQ:MRVL) are highlighted as likely outperformers for the AI theme according to the analyst.

"Spending patterns remain robust and we see no slowdown over the mid-term given criticality of investments. This group saw some of the greatest pullbacks during the recent SOX rollercoaster," Muse said of NVDA, AVGO, MU, MRVL and TER as AI picks.

The analyst mentions Intel Corporation (NASDAQ:INTC) as a potential value pick with its book value attractive, but not enough catalysts to drive upside for the stock.

"One would have to believe risk/reward is biased higher, and this will be an argument many make here."

Muse said this is the cheapest Intel has traded on a book value basis over the last three decades. "At the same time, the company is facing meaningful structural headwinds today and a still very uphill battle to regain its footing," Muse adds.

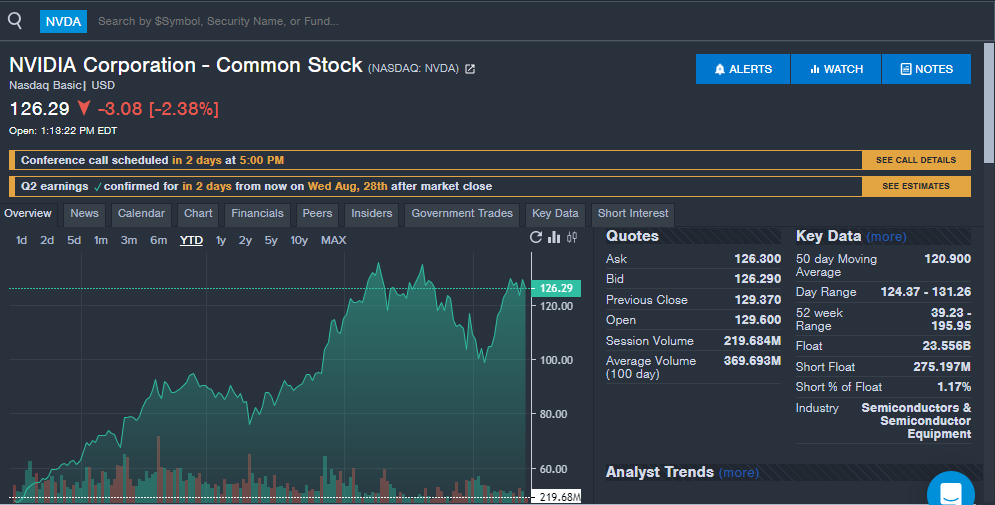

NVDA Price Action: Nvidia shares are down 3% to $126.90 on Monday, versus a 52-week trading range of $39.23 to $195.95. Nvidia stock is up over 150% year-to-date in 2024.

Read Next:

Photo: Shutterstock

Latest Ratings for NVDA

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Goldman Sachs | Reinstates | Neutral | |

| Feb 2022 | Summit Insights Group | Downgrades | Buy | Hold |

| Feb 2022 | Mizuho | Maintains | Buy |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: AIAnalyst Color Previews Reiteration Top Stories Analyst Ratings Tech Trading Ideas