Apple Watch Sales Pause Over Patent Issues Unlikely To Dent Revenue Significantly, Experts Weigh In

Apple Inc. (NASDAQ:AAPL) confirmed the cessation of sales for two of its watch models — the Apple Watch Series 9 and Apple Watch Ultra 2 — in the U.S. market.

This decision came in response to a patent infringement ruling involving the medical technology company Masimo, which, at first glance, might appear to be a significant setback for the tech giant.

However, leading equity analysts Samik Chatterjee, CFA, and Joseph Cardoso of JPMorgan believe that the financial impact on Apple may not be as severe as initially feared.

What Happened: In October, the International Trade Commission (ITC) upheld a judge’s ruling that Apple had violated Masimo’s patents, particularly in the technology used for measuring blood oxygen levels in its latest watch models. It’s important to note that this ruling excludes the SE line of products but has a significant impact on the Series 9 and Ultra 2 models.

Read Also: Tick Tock: Secure The Apple Watch Ultra 2 for $699 Before It’s Taken Off The Shelves

Financial Impact Analysis: As per IDC’s shipment estimates, Apple supplied 43.9 million Apple Watch units in 2022, with an average selling price (ASP) of approximately $466. Overall, Apple Watch revenues are pegged close to $20 billion. The newer models, including Series 9 and Ultra 2, reportedly account for about 80% of total shipments.

According to experts, given that approximately 30% of global smartwatch sales occur in the U.S., the theoretical impact of this ban could affect around $5 billion in sales, which translates to about 1% of Apple’s total revenue.

The final impact for the Cupertino-based tech giant could be even lower depending on the duration of the ban and Apple’s capability to redirect U.S. consumers towards older models.

Mitigating Factors: Apple is not sitting back passively in the face of this ruling. The company expressed its intention to appeal the ITC’s decision. Furthermore, Apple has formally asked the Biden administration to reconsider and potentially reverse this decision as part of the commission’s ongoing review, with a decision anticipated before Dec. 25.

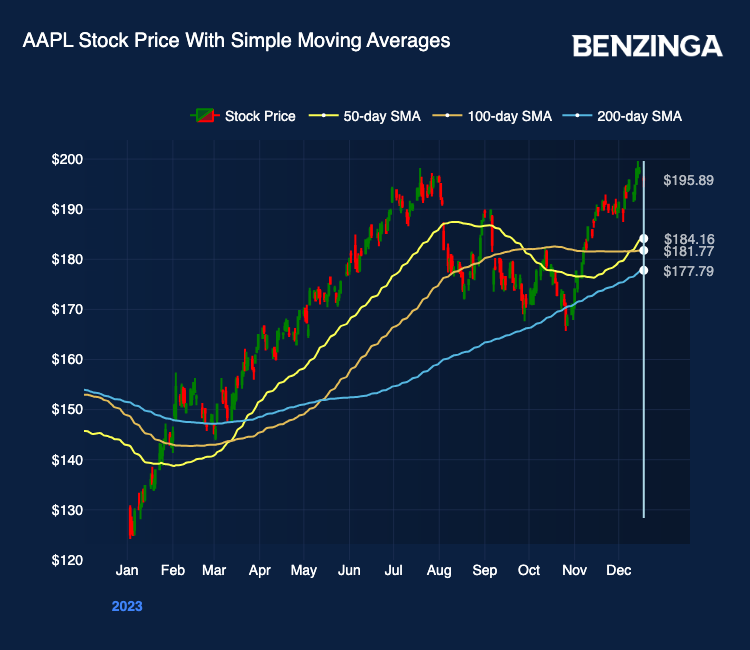

In terms of market performance, Apple Inc. experienced a 0.5% increase in its stock price on Tuesday, following a 0.9% drop on Monday. Remarkably, the stock recently reached an all-time high of $199.62 per share last week.

JPMorgan maintains an Overweight rating on Apple, with a 1-year price target of $225 per share, implying a 15% price increase from current levels.

Chart: AAPL’s Price Action In 2023

Read Now: Small Caps Are ‘Outperforming Everything,’ Analyst Says: This Rally’s Been ‘Years In The Making’

Photo: Apple Ultra 2, Series 9 watches, courtesy of Apple

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Analyst Color Government Long Ideas Price Target Top Stories Analyst Ratings Tech Trading Ideas