Microsoft Q2 'Darkest Before Dawn,' Says Analyst: CFO's Q3 Guidance, Forward Commentary On Earnings Call Suggest Otherwise

Microsoft Corp. (NASDAQ: MSFT) shares pulled back over 1% in after-hours trading on Tuesday in reaction to its fiscal year 2023 second-quarter results.

The Microsoft Analyst: Piper Sandler analyst Brent Bracelin maintained an Overweight rating and $247 price target for the shares.

The Microsoft Thesis: Microsoft’s quarterly results likely mark the "darkest before dawn," with non-Cloud business faltering and Azure public Cloud business growth moderating, Bracelin said.

See Also: How To Buy Microsoft (MSFT) Shares

The software giant’s constant currency growth slipped below 10% for the first time in five years, as Microsoft Cloud business moderated to 29%, the analyst said. The biggest drag was from the non-Cloud segment, which fell by $3.9 billion or 13% year-over-year to $25.6 billion, with Windows and Devices declining 30%, the analyst noted.

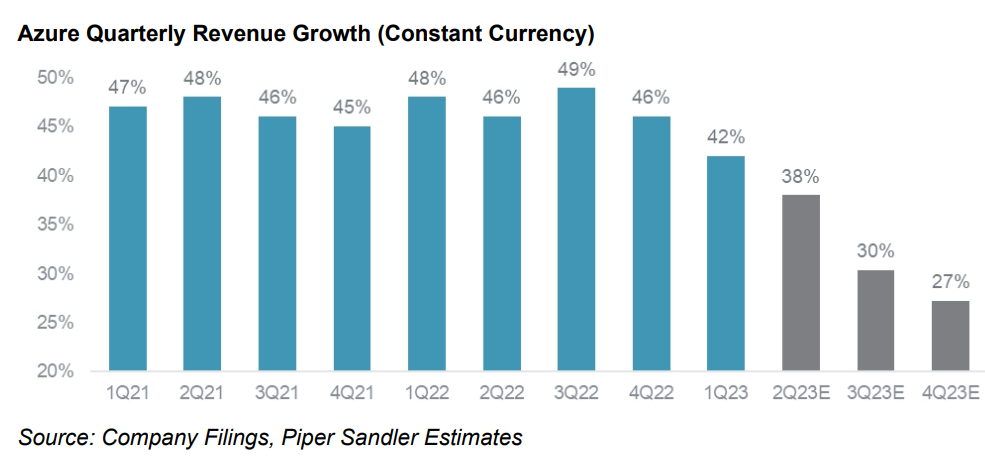

The Azure Cloud business, which quadrupled over five years to an annualized run rate of over $56 billion, is facing cloud elasticity and workload optimization trends, the analyst said. He sees this pressuring constant currency growth to below 30% over the next six months. But Microsoft is gaining share, going by Piper Sandler’s estimate for sub-20% growth for the Cloud industry, he added.

Source: Piper Sandler

Ahead of the fiscal year 2024, Microsoft’s layoffs could help realign the cost structure, the analyst said.

Piper Sandler maintained its 2023 earnings per share estimate of $9.26-$10.21, assuming tight expense management can partially offset recessionary headwinds, particularly in the non-Cloud segment, which accounts for 49% of sales.

Price Action: Microsoft shares, which initially rose in reaction to the quarterly results, retreated after CFO Amy Hood guided to below-consensus revenue for the third quarter and warned of the PC market contracting yet again.

The stock ended the after-hours session at $239.58, down 1.02%, according to Benzinga Pro data.

Latest Ratings for MSFT

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Tigress Financial | Maintains | Buy | |

| Jan 2022 | Citigroup | Maintains | Buy | |

| Jan 2022 | Morgan Stanley | Maintains | Overweight |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Analyst Color Earnings News Guidance Reiteration Top Stories Analyst Ratings Tech