Goldman Sachs Upgrades Pinterest On User Momentum, Monetization

Pinterest Inc (NYSE: PINS) appears to have witnessed strong user growth through the third quarter, as reflected by app download data and the prospects for continued monetization improvement, according to Goldman Sachs.

The Pinterest Analyst: Heath Terry upgraded Pinterest from Neutral to Buy and raised the price target from $37 to $61.

The Pinterest Thesis: Field checks and Snap Inc’s (NYSE: SNAP) latest results indicate strengthening advertiser demand through the third quarter, particularly for smaller platforms like Pinterest, Terry said in a Thursday upgrade note.

Recent app download data shows that elevated user acquisition trends may have continued through the third quarter, after strong second-quarter performance, when Pinterest reported more than 50 million net adds for monthly active users, the analyst said.

This could drive upside to estimates for revenue, MAU and consolidated average revenue per user, he said.

“While a degree of this strength is likely reflected in PINS shares already given the stock’s recent outperformance, we believe the long term monetization opportunity should drive further outperformance given the early stage nature of the company’s ad tech and sales investments, particularly outside the U.S,” Terry said.

Goldman's price target revision reflects “the potential for financial outperformance, faster growth, and margin improvements, as well as expansion in comp group multiples,” the analyst said.

PINS Price Action: Shares of Pinterest were down 0.69% at $49.04 at last check Thursday.

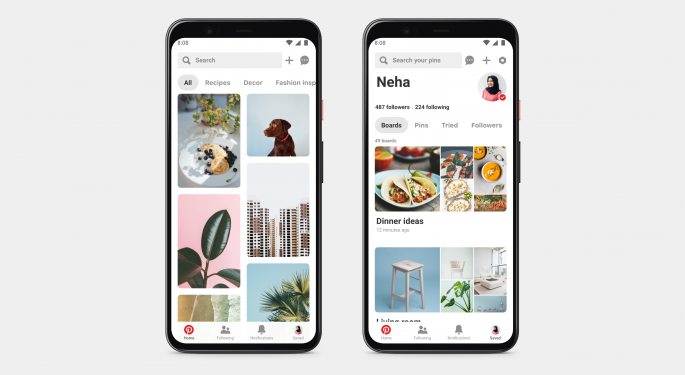

Photo courtesy of Pinterest.

Latest Ratings for PINS

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Benchmark | Initiates Coverage On | Hold | |

| Feb 2022 | Credit Suisse | Maintains | Neutral | |

| Feb 2022 | UBS | Maintains | Neutral |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Goldman Sachs Heath Terry social mediaAnalyst Color Upgrades Price Target Analyst Ratings Best of Benzinga