Wells Fargo Upgrades Uber, Sees More Compelling Price

Shares of Uber Technologies Inc (NYSE: UBER) have lost 45% since Feb. 6, versus a 28% decline for the S&P 500, and shares are now attractively priced, according to Wells Fargo.

The Uber Analyst

Brian Fitzgerald upgraded Uber from Equal-Weight to Overweight, while reducing the price target from $45 to $41.

The Uber Thesis

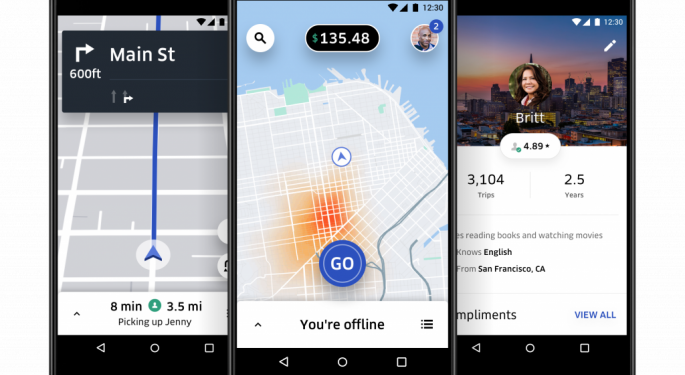

Uber’s value is still dependent on growth trends and this will play out only after the coronavirus-driven disruptions have subsided, Fitzgerald said in a note. He said growing smartphone penetration and continued shift in spend among riders from personal car ownership to ridesharing as favorable trends for the company.

See Also: Ex-Uber Executive Pleads Guilty To Stealing Google's Trade Secrets

Uber is well positioned for the challenging times ahead. Fitzgerald said the company is unlikely to face liquidity issues, as it exited fiscal 2019 with $10 billion of unrestricted cash and has a $2 billion revolver and $1.5 billion in covenant-free debt due in 2023.

Even with an 80% decline in volume in its Ridesharing segment, Uber will still exit fiscal 2020 with $4 billion of unrestricted cash, the analyst said.

“Two-thirds of Uber’s cost structure is variable, creating an automatic shock absorber against decreasing revenues," he wrote in the note.

Fitzgerald expects Uber to emerge from the crisis as a consolidator in the Meal Delivery space.

UBER Price Action

Shares of Uber rose 15% to $23.66 at time of publication Friday.

Latest Ratings for UBER

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Loop Capital | Maintains | Buy | |

| Mar 2022 | Deutsche Bank | Initiates Coverage On | Buy | |

| Feb 2022 | Wedbush | Maintains | Outperform |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Brian Fitzgerald Wells FargoAnalyst Color Upgrades Price Target Analyst Ratings Best of Benzinga