JPMorgan: 4 Positives At Dropbox Investors Are Overlooking

JPMorgan added Dropbox (NASDAQ: DBX) to its Analyst Focus List Wednesday and recapped its September meetings with the cloud storage company's management.

The Analyst

Analyst Mark Murphy reiterated an Overweight on Dropbox with a $35 price target.

The Thesis

Murphy isn’t convinced that the growth sell-off is over, but the analyst said Dropbox has improving risk-reward and the potential for 30-50-percent outperformance. (See his track record here.)

“We believe investors are underestimating the stability and consistency of the Dropbox engine and overlooking the launch and adoption of its premium plans,” the analyst said.

The following factors are overlooked, Murphy said:

- The aforementioned premium plans.

- Dropbox Paper and Showcase's roles as important new product drivers with increasing adoption rates.

- New average revenue per user levels and potential.

- An attractive growth-adjusted valuation.

“DBX shares have sold off to sub-$23. This has brought shares to a level of 5.6x EV/2019 revenue and 25x EV/2019 adjusted FCF, giving DBX among the lowest, if not the lowest, valuation for a [greater than] $1-billion recurring software revenue stream growing [at greater than] 20 percent,” the analyst said.

Dropbox reported approximately 400,000 additional paying users in the second quarter and left some investors disappointed in comparison to the last-12-month average of around 550,000, he said. Investors are missing positive trends like healthy top-line guidance and upward margin inflection, Murphy said.

“At this point, we believe investors are leaning the wrong way if they expect paying user adds to continue to drop, as oscillations in the ebb and flow of ARPU vs. paying user adds seem quite likely."

Price Action

Dropbox shares were down 0.35 percent at $22.67 at the time of publication Wednesday.

Related Links:

Dropbox Isn't Out Of The Woods Just Yet, Nomura Says In Upgrade

The Upwork IPO: What You Need To Know

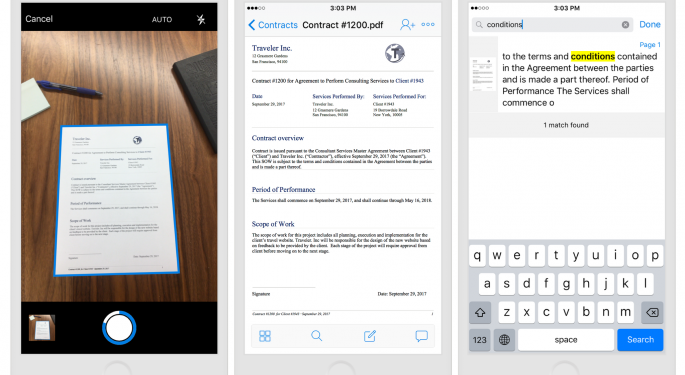

Photo courtesy of Dropbox.

Latest Ratings for DBX

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Dec 2021 | Berenberg | Initiates Coverage On | Hold | |

| Aug 2021 | RBC Capital | Maintains | Outperform | |

| Aug 2021 | JMP Securities | Maintains | Market Outperform |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Dropbox JPMorgan Mark MurphyAnalyst Color Price Target Reiteration Analyst Ratings Best of Benzinga