Citi Maintains Sell Rating On Roku, But Expects Positive Q4 Surprise

Roku Inc (NASDAQ: ROKU) reported its third-quarter results in early November, sending shares soaring higher by more than 50 percent. Heading into the company's fourth-quarter report Wednesday, investors could be treated to another surprise — but this isn't reason enough to buy the stock, according to Citi.

The Analyst

Citi's Mark May maintains a Sell rating on Roku's stock with an unchanged $28 price target.

The Thesis

Similar to Roku's Q3 report, the company could report upside to consensus estimates, which would push the stock higher, May said in a note. (See the analyst's track record here.)

Upside in Q4 would likely come from the advertising business, which remains small at $200 million per year — and management's guidance for the quarter was conservative, May said.

But Roku's current stock valuation already assumes an "overly optimistic" long-term view of the potential of its advertising business, he said.The analyst said he's adding Roku's stock to Citi's "Positive Catalyst Watch list," but also maintaining a Sell rating on the stock.

Price Action

Shares of Roku were trading higher by more than 6 percent Tuesday afternoon at $51.11.

Roku Analyst Warns Short Sellers To Close Their Positions

Consumer Reports Says Roku Smart TVs Hackable; Company Disputes

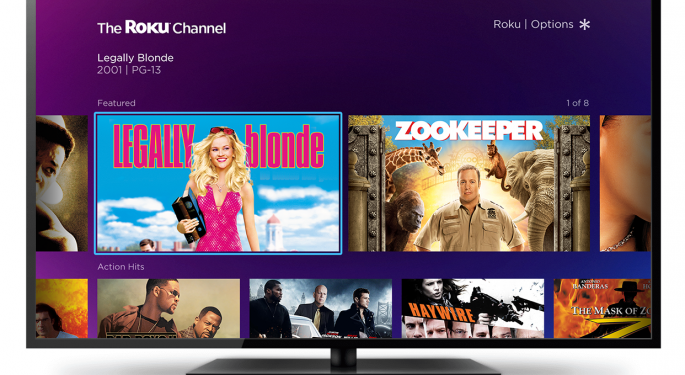

Photo courtesy of Roku.

Latest Ratings for ROKU

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Morgan Stanley | Maintains | Underweight | |

| Feb 2022 | Benchmark | Maintains | Buy | |

| Feb 2022 | Guggenheim | Maintains | Buy |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: advertising Citi Mark May streaming videoAnalyst Color Price Target Reiteration Analyst Ratings Best of Benzinga