SunTrust: PayPal Is Trading At A Premium Valuation

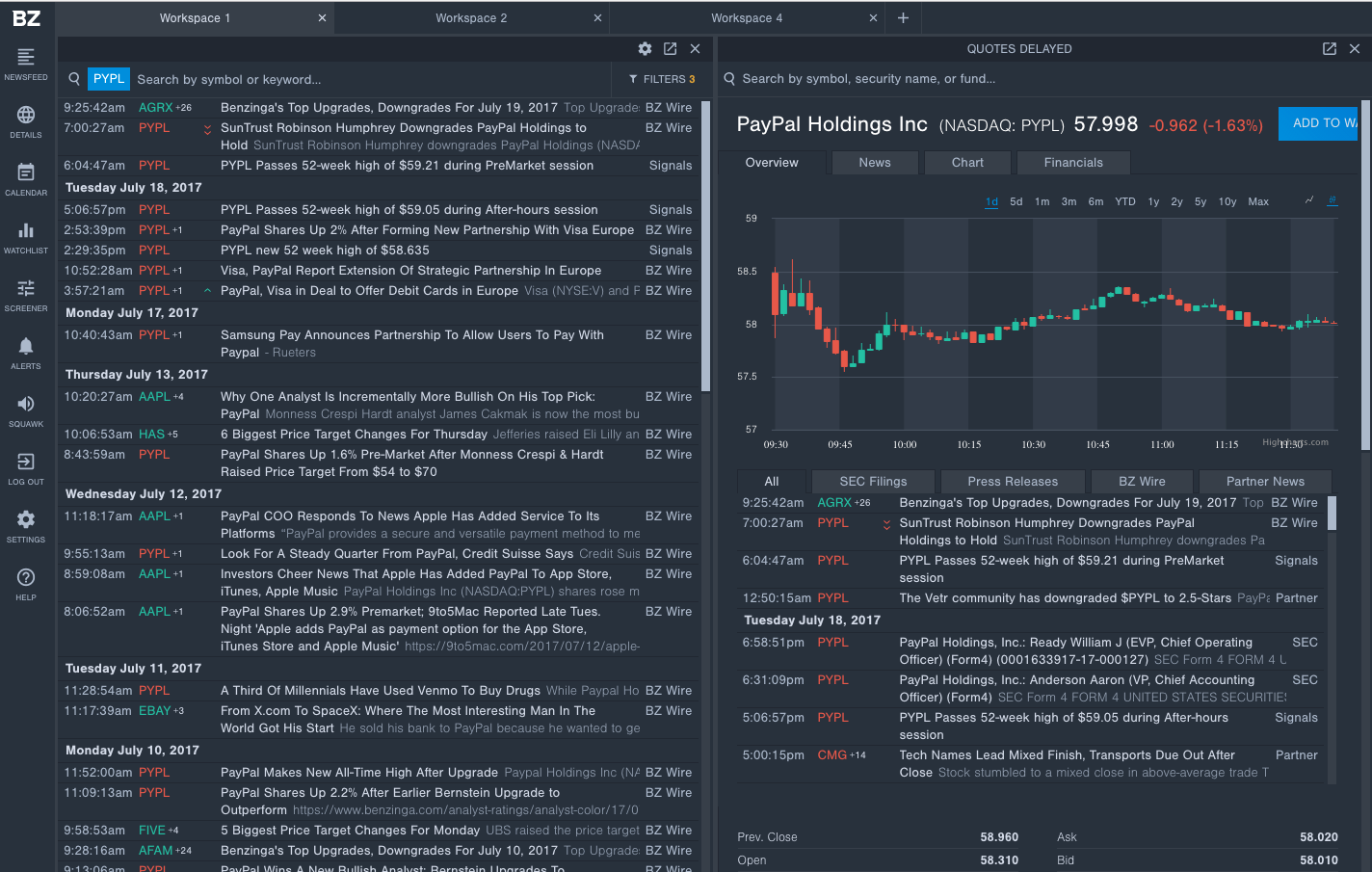

New partnerships with Apple Inc. (NASDAQ: AAPL), Samsung Pay, and Visa Inc (NYSE: V) Europe sent PayPal Holdings Inc (NASDAQ: PYPL) shares higher over the past week, leading SunTrust analyst Andrew Jeffrey to no longer see much upside.

“We argue that recent appreciation has materially priced in upside from pricing, Choice, OneTouch and better-than-expected EBIT margin,” Jeffrey wrote.

Jeffrey downgraded PayPal to Hold with a $60 price target.

PayPal Is Trading At A Premium Valuation

PayPal now trades at a premium valuation, in terms of NTM P/E, to both Visa and Mastercard Inc (NYSE: MA).

"We contend that Visa/Mastercard are more compelling secular growth vehicles, at comparable valuations, as they face less structural risk,” Jeffrey said.

Jeffrey noted there are several areas that could still serve as growth catalysts for PayPal - pricing increases, TPV growth, and operating leverage - but he sees them all already priced into PayPal’s current share price.

It All Comes Down To Venmo

Venmo remains the key growth driver for PayPal as Jeffrey noted Venmo’s “monetization is perhaps the greatest optionality for bulls and is not reflected in our model.”

PayPal has already started to roll out Venmo and is looking into testing Venmo debit cards that can be used at brick-and-mortar stores.

Could PayPal Still Continue Its Strong Run?

Jeffrey did note that PayPal appears poised to ride momentum afforded by its leadership in the eCommerce/mCommerce market, as well as discrete drivers. However, Internet-of-Things competitive risk and uncertain Venmo monetization balance the investment view.

Additionally, Joe Gallo, Senior Communication Manager for PayPal told Benzinga, "I think you will continue to see similar deals – partnerships are a part of our strategy."

PayPal reports Q2 earnings on July 26.

To read the latest and exclusive financial news, check out the Benzinga Pro news wire.

Latest Ratings for PYPL

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | B of A Securities | Downgrades | Buy | Neutral |

| Feb 2022 | Mizuho | Maintains | Buy | |

| Feb 2022 | Barclays | Maintains | Overweight |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Andrew Jeffrey SunTrustAnalyst Color Downgrades Price Target Analyst Ratings Best of Benzinga