Why Some Are Expecting Another Guidance Cut From VeriFone

Visa Inc (NYSE: V) and Mastercard Inc (NYSE: MA) announced on Thursday that they would delay the liability shift for EMV migration at fuel pumps from October 2017 to October 2020. Following this news, Stifel analysts Christopher C. Brendler, John Davis and Joab Dempsey decided to downgrade their rating on shares of VeriFone Systems Inc (NYSE: PAY) to Hold.

As per a report issued Friday, the experts see this move as “the final straw,” after sticking with the stock in spite of two recent disappointments. “This time, we believe we have an opportunity to be more prescient and prefer to step aside before the company reports fiscal 4Q results in 10 days,” the analysts pointed out.

While the experts believe VeriFone’s guidance carried enough slack to remain unchanged in the face of this adversity, they think the likeliness is not particularly elevated, especially taking into account the firm’s estimate of “how material fuel upgrades are to PAY's 2017 outlook.”

Consequently, and in spite of their confidence in the management team and their belief that the pumps issue largely escaped its control, they decided to move to the sidelines, cutting their price target from $18.00 to 15.00.

VeriFone shares closed Friday down 4.55 percent at $15.52.

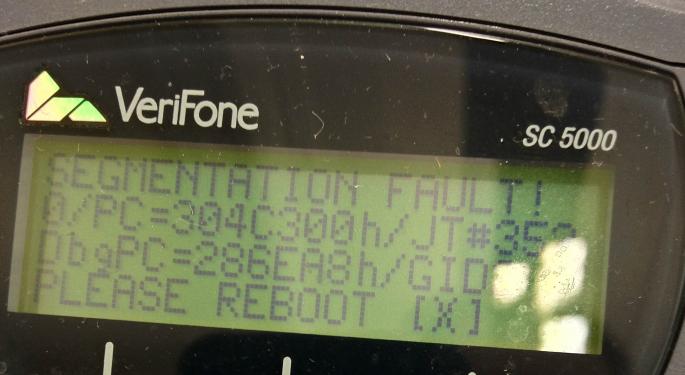

Image Credit: By secretlondon123 (Flickr: card reader segfault) [CC BY-SA 2.0], via Wikimedia Commons

Latest Ratings for V

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jan 2022 | Barclays | Maintains | Overweight | |

| Jan 2022 | Wedbush | Maintains | Outperform | |

| Jan 2022 | Raymond James | Maintains | Outperform |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Analyst Color News Guidance Downgrades Price Target Previews Analyst Ratings Movers Best of Benzinga