Disney's Theme Park And Film Success Offset Misses In Other Segments

Walt Disney Co (NYSE: DIS) reported Q3 adjusted EPS of $1.62 vs. $1.61 estimates and revenues of $14.277 billion vs. $14.15 billion estimates.

Goldman Sachs’ Drew Borst commented on Disney’s three major announcements and recent theme park successes despite the rise of zika and other dangers, especially in Florida.

“Relative to consensus, the beat was driven by Parks and Studio opex, which more than offset misses in other segments,” stated Borst. The positive park's results, however “took a back seat” to three over-the-top announcements that both reinforced Disney’s lucrative traditional pay TV model while embracing new over-the-top opportunities.

Major Announcements

These three major announcements, according to Borst, were as follows:

- $1 billion worth of investments for a 33 percent stake in BAMTech, the “leading technology infrastructure company for streaming video.”

- ESPN will launch a direct-to-consumer streaming service that will feature live sports rights from both BAMTech and ESPN later this year.

- The signing of a license deal with AT&T (NYSE: T) and Comcast (NASDAQ: CMCSA) to expand Disney’s video-on-demand license deal.

The analyst believed expanding on demand rights were key to bolstering traditional pay TV services.

ESPN Struggles

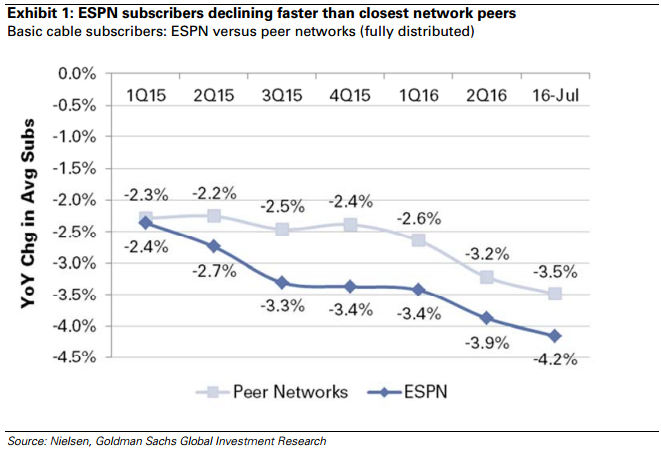

“Disney’s Cable Network segment– which accounts for 43% of operating profit and is driven by ESPN– has been under investor scrutiny for more than a year now,” said Borst. The Goldman analyst believed FY17 cable network income would decline 4 percent, partly due to ESPN’s weakness trend shown below.

Reflecting, lower CY2017 EPS estimates, Borst lowered Disney’s price target from $109.00 to $108.00 while maintaining the company’s Neutral rating.

At time of writing, Disney traded at $95.20, down 1.52 percent in Wednesday's pre-market.

Latest Ratings for DIS

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | MoffettNathanson | Maintains | Neutral | |

| Feb 2022 | Citigroup | Maintains | Buy | |

| Feb 2022 | JP Morgan | Maintains | Overweight |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: BAMTechAnalyst Color Earnings News Price Target Reiteration Top Stories Analyst Ratings Best of Benzinga