Sterne Agee CRT Starts Tesla At Buy With $300 Target; Sees $32 Billion In Revenue By 2019

After the close on Thursday, Sterne Agee CRT initiated coverage on Tesla Motors Inc (NYSE: TSLA). Analyst Rob Cihra feels the risk, controversy and expensive nature of the shares is just "the price for nearly open-ended growth in a technology innovator. targeting trillion dollar auto and energy markets."

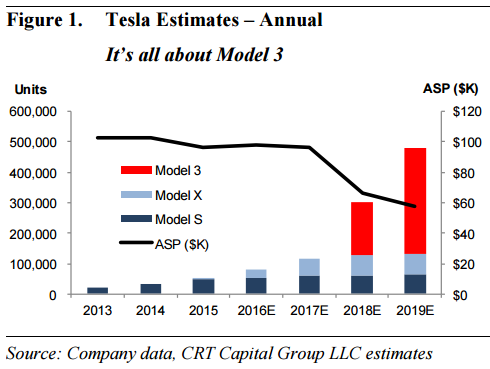

Cihra expects Tesla to generate under $9 bullion in revenue through 2016, however, he expects Tesla to reach revenues of $32 billion by 2019.

Cihra sees some near-term issues for the stock: "[W]e believe its biggest achievement has so far been proving there is EV demand, with manufacturing supply no cake-walk but something we think can come with time and money."

As for that "time and money" thing, Cihra says, "Tesla is burning cash and losing money as it invests for far higher volumes than today's, but we forecast that big capex and fixed-cost base providing big leverage once higher volumes ultimately ramp."

No real surprise, it's all about the Model 3:

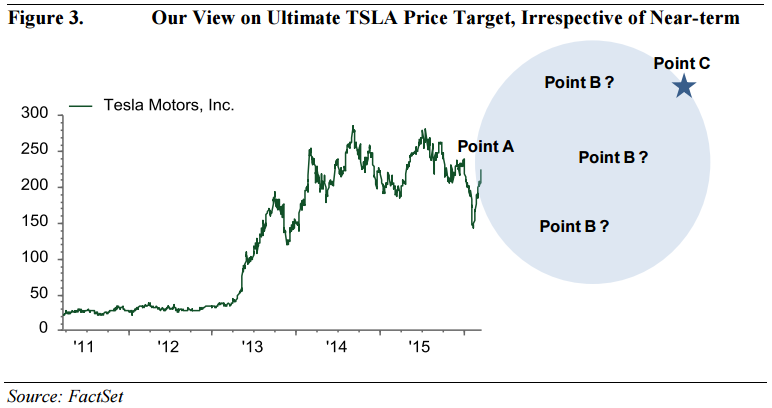

All this risk to the price and company performance makes for one heck of a great effort by the analyst to figure out just how the stock will trade in the foreseeable future:

Shares of Tesla were up in after-hours trading at $220.25, up $1.29 or 0.59 percent.

Latest Ratings for TSLA

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Daiwa Capital | Upgrades | Neutral | Outperform |

| Feb 2022 | Piper Sandler | Maintains | Overweight | |

| Jan 2022 | Credit Suisse | Upgrades | Neutral | Outperform |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Rob Cihra Sterne Agee CRTAnalyst Color Price Target Initiation After-Hours Center Analyst Ratings Best of Benzinga