PacCrest's Twigg Not Buying ExOne Yet; Stock Up 4%

Pacific Crest Securities recently issued a company note on ExOne Co (NASDAQ: XONE) after the company posted good fourth-quarter earnings; however, revenue visibility continues to remain low. Currently, analysts at Pacific Crest rate ExOne at Sector Weight, while a price target is unavailable.

Weston Twigg and Daniel Baksht, analysts at Pacific Crest, wrote, "XONE may be recovering along with other 3D printing names, but we still lack conviction in the rate of new customer traction and long-term revenue growth. The company posted good Q4 results, led by backlog conversion. However, we would remain on the sidelines until we see evidence of sustainable binder-jetting product traction."

Justification

Analysts at Pacific Crest gave one key reason why ExOne Company may bring shareholder value in future fiscal periods: growing customer base may drive revenue growth.

Pacific Crest noted that ExOne has a growing industrial customer base with the ability to leverage their unique printing capabilities. Analysts also believe that there will be a rapid growth in 3D printing services, which ExOne could take advantage of. ExOne also has a total order machinery and services backlog of $16.5 million, which is key to giving the company stability if orders decline or remain flat in the short term.

ExOne was recently seen trading at $12.61, up 4.04 percent.

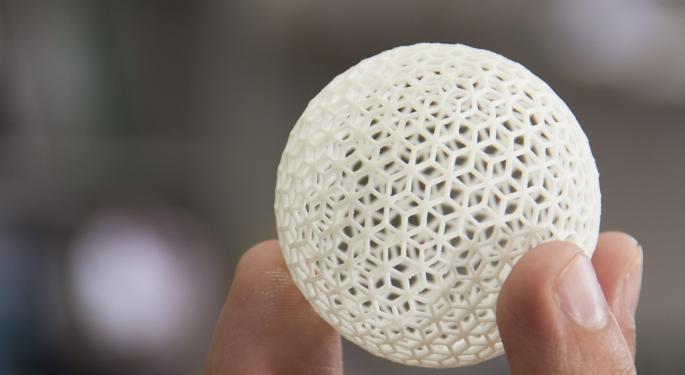

Image Credit: Public Domain

Latest Ratings for XONE

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Aug 2021 | Stifel | Downgrades | Buy | Hold |

| Aug 2021 | Alliance Global Partners | Downgrades | Buy | Neutral |

| Aug 2021 | Canaccord Genuity | Downgrades | Buy | Hold |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: 3D PrinterAnalyst Color Long Ideas News Analyst Ratings Movers Tech Trading Ideas Best of Benzinga