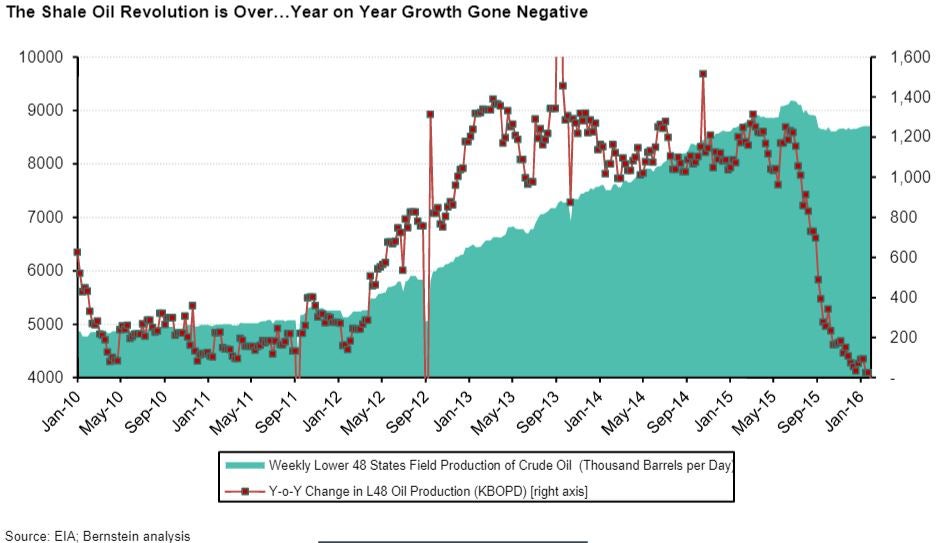

The Shale Revolution Is Over

In a new report, A.B. Bernstein analyst Bob Brackett looked at the boom and bust of the U.S. shale revolution.

Starting in 2006, U.S. gas supply grew 28 BCFD (44 percent), including explosive growth in Arkansas (341 percent), West Virginia (449 percent) and Pennsylvania (2,579 percent). In addition, from the end of 2012 to the middle of 2015, U.S. oil supply grew by 1 million BOPD annually. However, the U.S. finally reached the tipping point for production growth last week with growth crossing over into negative territory for the first time.

While the U.S. shale industry is far from out of the water just yet, Brackett sees this transition as the official end of the U.S. shale revolution.

“Falling supply and resilient demand will allow oil inventories to drain in the second half of the year, leading to improved pricing,” Brackett explained.

Bernstein sees falling inventories as a buying opportunity for investors.

A Few Names

The firm has Outperform ratings on the following stocks:

- Apache Corporation (NYSE: APA)

- Cobalt International Energy, Inc. (NYSE: CIE)

- Cabot Oil & Gas Corporation (NYSE: COG)

- ConocoPhillips (NYSE: COP)

- Devon Energy Corp (NYSE: DVN)

- EOG Resources Inc (NYSE: EOG)

- Range Resources Corp. (NYSE: RRC)

- Southwestern Energy Company (NYSE: SWN)

Disclosure: The author holds no position in the stocks mentioned.

Image Credit: Public Domain

Latest Ratings for APA

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Piper Sandler | Maintains | Neutral | |

| Mar 2022 | Keybanc | Maintains | Overweight | |

| Mar 2022 | Keybanc | Maintains | Overweight |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: A. B. BernsteinAnalyst Color Long Ideas Commodities Top Stories Markets Analyst Ratings Trading Ideas Best of Benzinga