Are Analog Devices' Numbers A Bad Omen For The Global Economy?

Quarterly earnings reports and guidance are always important for shareholders, but Moneyball Economics analyst Andrew Zatlin believes that there are two companies with particularly meaningful numbers. According to Zatlin, Rockwell Automation and Analog Devices are two of the best leading U.S. economic indicators available.

What Do Rockwell’s Numbers Say?

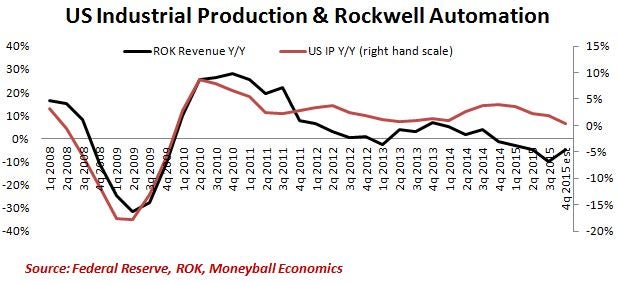

Since a large amount of Rockwell’s chips are used in factory automation, mining equipment, oil infrastructure and other heavy industrial settings, Zatlin sees the company as a bellwether for U.S. industrials. He believes that Rockwell’s diverse customer base makes it an even better indicator than Caterpillar Inc. (NYSE: CAT).

Since Rockwell recently guided for no growth until the second half of 2016, Zatlin predicts that U.S. Industrial Production will likely be stagnate until at least Q3 of next year.

What Do Analog Devices Numbers Say?

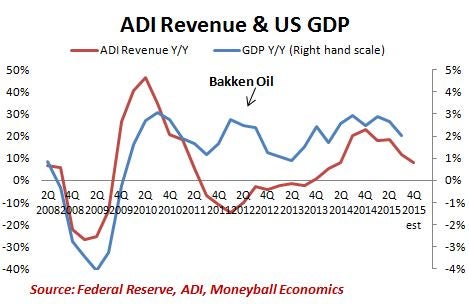

Analog Devices, on the other hand, is Zatlin’s preferred leading U.S. GDP indicator. He likes Analog because it has about 50 percent market share in the electronic chip market in the U.S. The company’s chips are used in a wide range of electronic arenas, including consumer products, telecommunications, industrial, medical devices, autos and others.

Analog’s revenue growth has been trending in the wrong direction in recent quarters and appears to be headed below 8.0 percent. This trend indicates to Zatlin that U.S. GDP growth will soon dip back below 2.0 percent.

China Is Key

With both Analog Devices and Rockwell indicating a tough 2016 to come, Zatlin believes that China’s willingness to stimulate its economy could be the key to 2016 global growth. “Betting against the Chinese market today may be a sucker’s bet,” he wrote.

The earliest indication of Chinese stimulus will likely come in January when China announces its 2016 fiscal spending plan.

Disclosure: The author holds no position in the stocks mentioned.

Image Credit: By Ryan Lawler (Own work) [Public domain], via Wikimedia Commons

Latest Ratings for ROK

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jan 2022 | Credit Suisse | Maintains | Neutral | |

| Jan 2022 | Bernstein | Initiates Coverage On | Outperform | |

| Dec 2021 | Mizuho | Initiates Coverage On | Neutral |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Andrew ZatlinAnalyst Color Long Ideas News Econ #s Economics Analyst Ratings Trading Ideas Best of Benzinga