REITWeek Data Center Report - Stifel Meets With QTS Realty Team

After the QTS Realty Trust Inc (NYSE: QTS) REITWeek Investor Forum presentation, Stifel analyst Matthew Heinz sat down with the QTS management team, including CEO Chad Williams, CFO Bill Schafer and CIO Jeff Berson.

QTS refers to its primary product offerings as its "3Cs" – C1 custom wholesale, C2 colocation and C3 cloud and managed services.

Heinz reported on 3Cs of his own, which were "Capital Allocation, Carpathia and Continued Leasing Momentum."

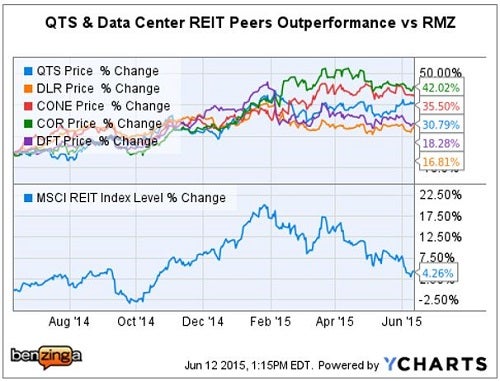

Tale Of The Tape: Past Year

Secular drivers for data center REITs include exponential growth of: cloud computing, big data and wireless data, as well as IT infrastructure outsourcing.

Stifel–QTS Realty: Maintains Buy Rating, $45 PT

The Stifel $45 target price represents a potential 18.9 percent upside from QTS Realty's recent close of $37.85 per share.

The QTS $45 PT is based upon 16x Stifel's 2016 pro forma AFFO estimate (including Carpathia).

Stifel–QTS: REITWeek Meeting Highlights

Capital Allocation: "Basis is forever" has been the QTS mantra since its 2013 IPO. Acquiring large, infrastructure-rich properties at a significant discount to replacement cost gives QTS its low basis, which can be a competitive advantage.

- QTS top priority is the redevelopment of existing properties, which represent a five-year growth pipeline from land and building shells available for future development.

- Heinz noted that the expected stabilized yields for existing redevelopment opportunities is 15 percent, which "provides a hurdle rate of return for all non-organic opportunities."

- QTS acquisition strategy targets three primary buckets including:

- 1. Strategic M&A (i.e., Carpathia)

- 2. One-off properties (i.e. Richmond, Dallas, Chicago)

- 3. Enterprise sale-leasebacks (i.e., McGraw Hill)

- While QTS has a successful track record when it comes to numbers two and three above, Heinz noted that the $326 million Carpathia acquisition and integration is the first of its kind for the company.

Carpathia Synergies: QTS management sees three distinct areas where benefits should accrue:

- 1. Operating expenses: QTS management has guided "to $2 million of annual run-rate synergies from the elimination of redundant C3 costs and enhanced facilities management efficiency.

- 2. Revenue acceleration: QTS will have an opportunity to cross-sell its existing C1 and C2 customers the Carpathia suite of hybrid cloud management tools and solutions. Additionally, Carpathia's FedCloud ecosystem combined with QTS' FedRamp certification for security and compliance should help generate top line growth.

- 3. Facility migration: As Carpathia and its customer base third-party leases terminate over the next few years, QTS can attempt to selectively migrate them to QTS owned facilities where it can be done without disrupting critical applications and services.

Continued Leasing Momentum: QTS bookings "remain robust in core markets" including: Richmond, Dallas and Atlanta.

- Heinz noted, "This continues the strong pace set in 1Q15 with $13.6 million of incremental annualized MRR [monthly recurring revenue] signed, driving the BNB [booked not billed] backlog up 11 percent q/q to a new record at $64.3 million."

- QTS backlog is expected to decline, with "$22.0 million of annualized rent (34 percent of MRR backlog) expected to commence over the balance of this year, equating to $9.7 million of incremental revenues."

- Redevelopment of the former Chicago Sun Times press facility is on track to open in mid-2016, with billings expected to begin as soon as 2H 2016.

Image Credit: Public Domain

Latest Ratings for QTS

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jun 2021 | Truist Securities | Downgrades | Buy | Hold |

| Jun 2021 | Wells Fargo | Downgrades | Overweight | Equal-Weight |

| Jun 2021 | BMO Capital | Downgrades | Outperform | Market Perform |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Analyst Color Long Ideas REIT Currency ETFs Events Top Stories Analyst Ratings Tech Best of Benzinga