Apple's China Footprint...In 10 Charts

Apple Inc. (NASDAQ: AAPL) shares are down 0.5 percent on Thursday morning, and while the market may be focused on a text message bug, there's another story brewing on Wall Street.

UBS analysts Steven Milunovich and Peter Christiansen just issued a massive note on Apple in China.

The country is the primary "driver" of growth at the tech giant, UBS said. So much so, in the firm's eyes, that it holds a 12-month Buy rating on Apple with a $150 price target.

Check out 10 graphics UBS compiled in the Apple report.

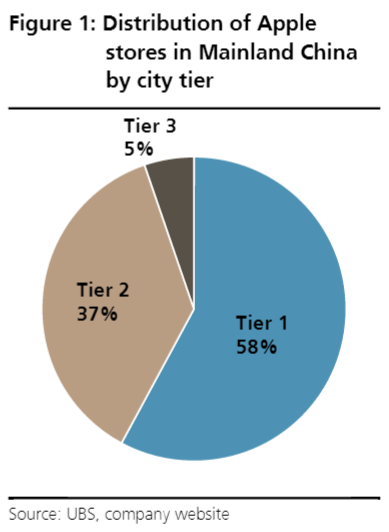

Tier 1 cities make up the majority of Apple store distribution in China.

iPhone sales in China are becoming more important to the tech giant.

Premium smartphone share is growing at a time when competitors are shrinking or stagnant.

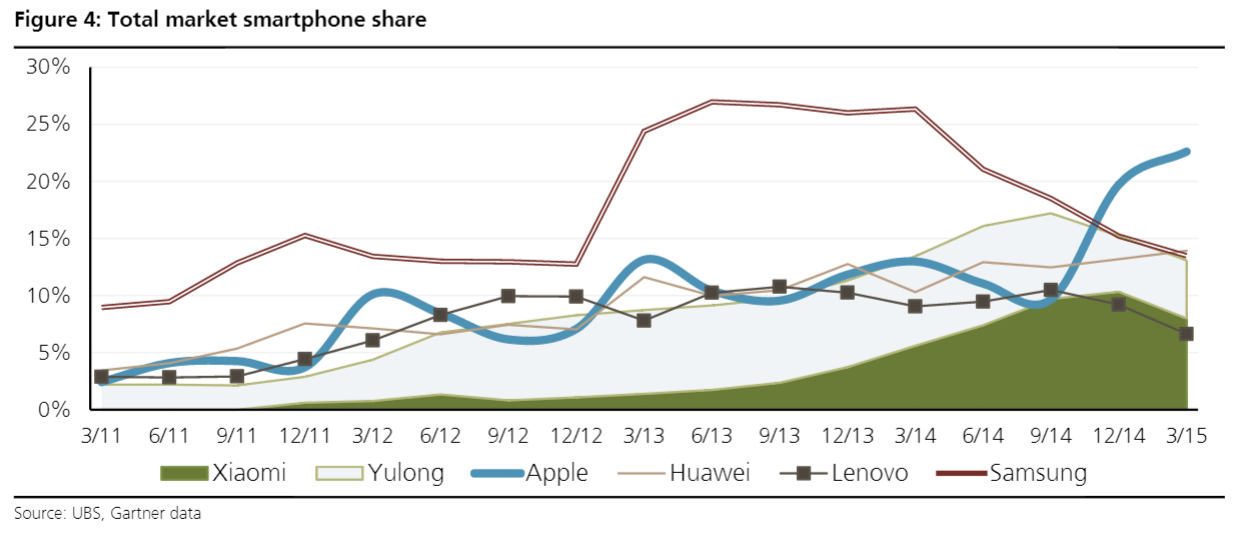

Total smartphone share is also healthy.

Market share is expanding no matter how you look at it.

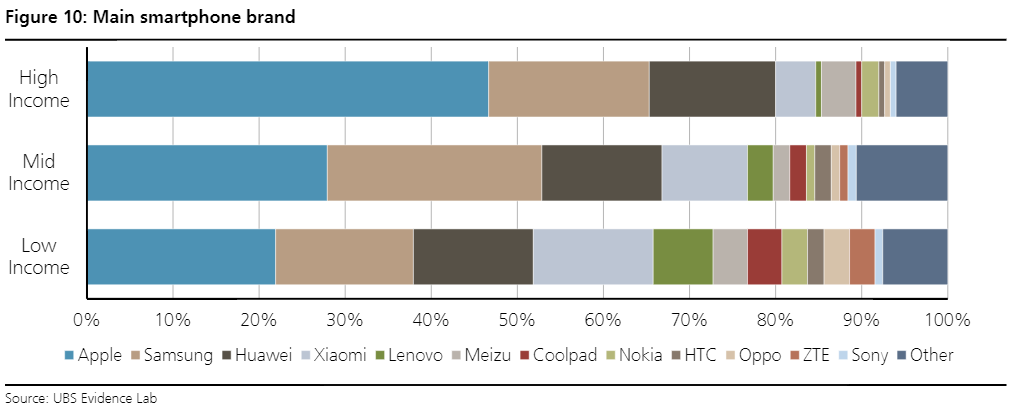

The iPhone sells at multiple income levels in China.

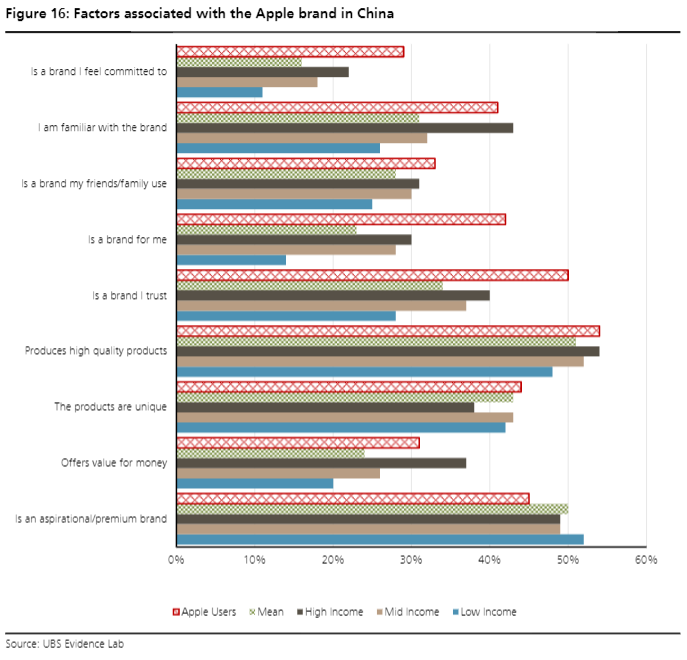

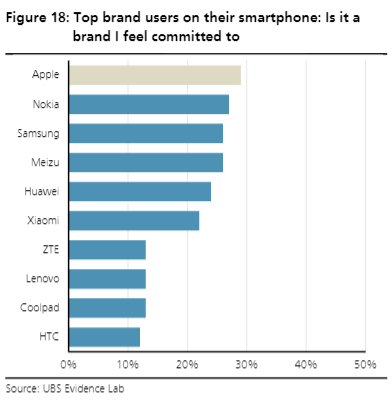

The brand is trusted.

And users are committed.

Latest Ratings for AAPL

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Barclays | Maintains | Equal-Weight | |

| Feb 2022 | Tigress Financial | Maintains | Strong Buy | |

| Jan 2022 | Credit Suisse | Maintains | Neutral |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Analyst Color Long Ideas Emerging Markets Top Stories Markets Analyst Ratings Tech Trading Ideas Best of Benzinga