Outerwall To Deliver Upbeat Results On Strong Core Business? Experts & Crowd Opine

Outerwall Inc (NASDAQ: OUTR) is scheduled to announce first quarter financial results after the market closes.

A look at Estimize shows that experts and the crowd both anticipate more than 30 percent year-over-year earnings growth. However, quarter-over-quarter, they expect to see a decline of more than 30 percent.

For the first quarter last year, the company reported earnings of $1.27 per share on revenue of $600.4 million. Last quarter, earnings came in at $2.44 per share on revenue of $600.6 million.

For the first quarter of 2015, the Street anticipates consensus earnings of $1.67 per share on revenue of $598.56 million, while the crowd projects earnings of $1.76 per share on revenue of $594.04 million.

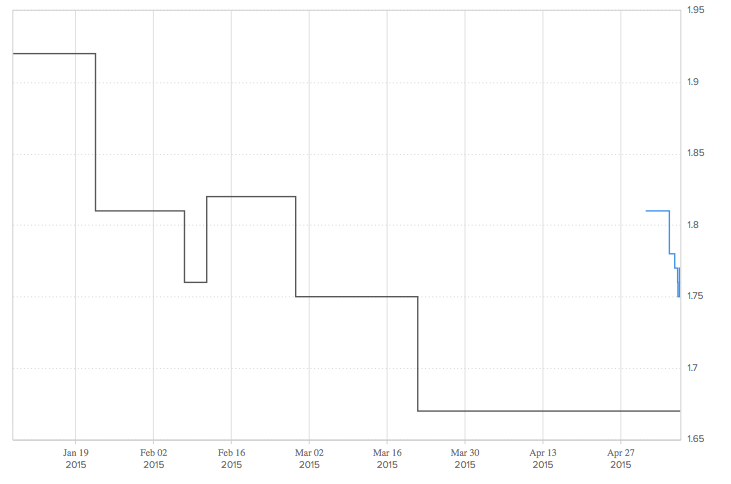

The chart below features a history of Outerwall’s actual earnings compared to estimates over the past couple of years. The company has comfortably and consistently beat consensus for, at least, the past two years.

It is also possible to see how sentiment has changed over time.

As the earnings date got closer, both Wall Street’s and Main Street’s expectations became lower.

Strong Core

In a report published Monday, analysts at Wedbush said they expect the company to report revenue and earnings significantly ahead of the consensus on the back of its strong core business, and, specifically, on the price hikes in Redbox implemented in December 2014: “Wedbush expects its estimate to prove to be too low, given Outerwall's DVD rental price hikes of 25-30 percent in December. Redbox is expected to post its comps in the high single digits. With the DVD box office segment witnessing improvements through 2015.”

The analysts added that they "do not expect the core business to decline, and believe that the EBITDA guidance range reflects increased investment in growing existing businesses.”

Latest Ratings for OUTR

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jul 2016 | Wedbush | Downgrades | Buy | Neutral |

| Jul 2016 | Roth Capital | Downgrades | Neutral | Sell |

| Mar 2016 | Roth Capital | Upgrades | Sell | Neutral |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Estimize RedboxAnalyst Color Previews Crowdsourcing Analyst Ratings Trading Ideas General