What To Expect From Monster Beverage's Earnings

Shares of Monster Beverage Corp (NASDAQ: MNST) were up 2.4 percent on Thursday in anticipation of the announcement of the company’s first quarter financial results after the bell.

According to Estimize, experts and the crowd both anticipate double-digit year-over-year earnings growth, but a slight decline in relation to last quarter.

For the first quarter of 2014, Monster Beverage reported earnings of $0.55 per share (about 12 percent above consensus) on revenue of $536.12 million. Last quarter, earnings came in at $0.72 per share (about 20 percent above estimates) on revenue of $605.57 million.

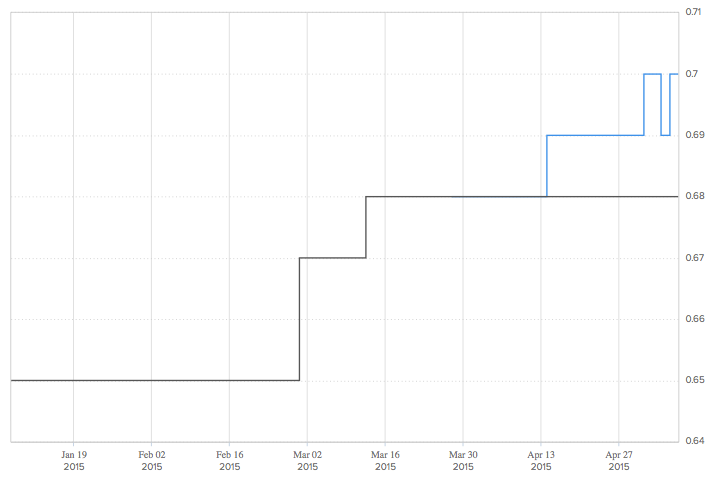

For the first quarter of the current year, the Street models consensus earnings of $0.68 per share on revenue of $603.48 million, while the crowd anticipates earnings of $0.70 per share on revenue of $611.06 million.

A look at the above chart, which compares Monster Beverage’s actual earnings to estimates, shows that the company has beat estimates over the past four quarters.

A second graph illustrates the evolution of consensus since the beginning of the year. Both the Street and the crowd have become increasingly constructive as earnings loomed.

Is Monster Beverage Running Low On Energy?

A recent Zacks article previews Monster Beverage’s results. The firm says that energy drinks have been gaining importance in the not-so-well-performing carbonated soft drinks (CSD) category.

However, several other headwinds have been affecting Monster Beverage’s profits over the past few quarters. “New Monster Energy branded products like Ultra and Muscle Monster are cannibalizing sales of the existing brands like Absolutely Zero, Rehab, Import and Lo-Carb. We expect the trend to continue in the first quarter. Also unfavorable currency transactions are likely to hurt quarterly results.

"Moreover, Monster Beverage has been involved in several controversies. The Food and Drug Administration (FDA) is currently investigating the impact of caffeine in food and dietary supplements, which includes Monster Beverage products. All these regulatory and litigation issues are increasing Monster Beverage’s professional service expenses, which are eroding margins.”

Latest Ratings for MNST

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Stifel | Maintains | Buy | |

| Feb 2022 | Citigroup | Maintains | Buy | |

| Feb 2022 | Credit Suisse | Maintains | Outperform |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Estimize ZacksAnalyst Color Previews Crowdsourcing Analyst Ratings Trading Ideas General