Jefferies Updates Self-Storage REITs - Top Picks After Strong Q1 Earnings

On Tuesday, Jefferies & Company published a research report updating the self-storage REIT sector and adjusting price targets after Q1 earnings and guidance.

Below are the four companies Jefferies commented on in its research report:

- CubeSmart (NYSE: CUBE): $3.9 billion cap, 2.73 percent yield.

- Extra Space Storage, Inc. (NYSE: EXR): $7.8 billion cap, 2.82 percent yield.

- Public Storage (NYSE: PSA): $33 billion cap, 2.93 percent yield.

- Sovran Self Storage Inc (NYSE: SSS): $3.1 billion cap, 3 percent yield.

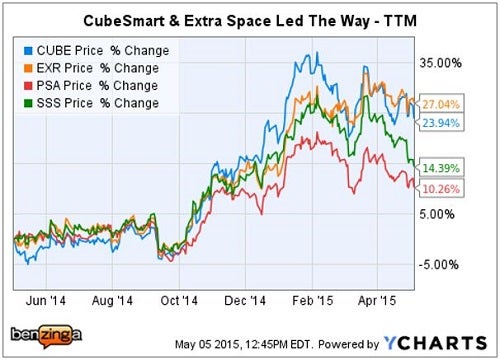

Tale Of The Tape – Past Year

Notably, a fifth publicly traded self-storage REIT, $548 million cap National Storage Affiliates Trust (NYSE: NSA), began trading with its IPO debut just this past April.

Jefferies - Self-Storage Sector: Big Picture

- Consensus Estimates: Jefferies noted that all four self-storage REITs met or beat consensus estimates for Q1 2015.

- ssNOI: Same-store NOI (ssNOI) growth was stronger than expected across the board.

- New Move-ins/Renewals: Rent growth on new move-ins and renewals was in high-single digits.

- Occupancy: Improved occupancies imply self-storage REITs will have pricing power going into Q2 spring season.

- Bullish Outlook: Jefferies remains "bullish on the fundamentals for the sector as a whole."

Jefferies - CubeSmart: Buy, $27 PT

Jefferies' $27 price target represents a potential 15 percent upside based upon a May 4 close of $23.47 per share for a total return of 17.7 percent, including dividend yield.

Notably, while Jefferies' core FFO estimates for FY 2015 and FY 2016 remain unchanged at $1.21 and $1.33, respectively, they are above consensus estimates.

On the call, CubeSmart management reported increased new development activity (28 new stores under development in top ten metro markets); however, the silver lining is that many of these facilities will be looking for third-party management.

Jefferies noted that CubeSmart expects to manage several of these facilities, while the trend is also likely to benefit Extra Space and, "to a lesser extent," Sovran.

Jefferies projects CubeSmart will deliver 2015 FFO per share growth of 12 percent.

Jefferies - Extra Space: Buy, PT Raised From $75 To $77

The Jefferies' new $77 price target represents a potential 15.4 percent upside based upon a May 4 close of $66.72 per share for a total return of 18.2 percent, including dividend yield.

Jefferies increased Extra Space core FFO per share "primarily due to stronger Q1 results than expected."

Jefferies' new FFO estimates are $3.00 FY 2015 and $3.29 FY 2016, up from $2.97 and $3.26 per share, respectively.

Jefferies projects Extra Space "will deliver the strongest 2015 FFO per share growth in the sector at 15 percent."

Jefferies - Public Storage: Hold, PT Raised To $205 From $200

The Jefferies' new $205 price target represents a potential 7.25 percent upside based upon a May 4 close of $191.15 per share for a total return of 10.2 percent, including dividend yield.

Jefferies noted that the 21 percent Public Storage dividend increase, from $1.40 to $1.70 per share was higher than expected, and the new $205 PT was derived from updates to its dividend discount model (DDM).

However, Jefferies actually reduced its core FFO per share estimate for 2015 from $8.63 from $8.70, to reflect higher anticipated G&A costs. Jefferies also reduced its 2016 FFO estimate a penny to $9.28 per share.

Jefferies projects that Public Storage will deliver 2015 FFO per share growth of 7 percent.

Jefferies - Sovran Self Storage: Buy, $104 PT

The Jefferies' $104 price target represents a potential 18.5 percent upside based upon a May 4 close of $87.80 per share for a total return of 21.5 percent, including dividend yield.

Jefferies raised its Sovran Self Storage core FFO estimates "due to the improved outlook and guidance raise by management."

Jefferies' new FFO estimates are $4.84 FY 2015 and $5.36 FY 2016, up from $4.81 and $5.29 per share, respectively.

Jefferies noted that according to new CEO Dave Rodgers, "Growth of new supply is picking up, but for the most part, the new stores are needed and well placed;" that said, new supply still not keeping up with demand from population growth.

Jefferies projects that Sovran Self Storage will deliver 2015 FFO per share growth of 11 percent.

Jefferies - Bottom Line

Jefferies' Top Pick in the space is CubeSmart, "given the 12 percent projected FFO per share growth in 2015, combined with the stock trading at 19.4x 2015 FFO, a discount to EXR at 22.2x and PSA at 22.2x."

Jefferies also likes Extra Space, and projects that "it will deliver the strongest 2015 FFO per share growth in the sector at 15 percent."

Image Credit: Public Domain

Latest Ratings for CUBE

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Dec 2021 | Truist Securities | Maintains | Hold | |

| Dec 2021 | Raymond James | Upgrades | Market Perform | Outperform |

| Oct 2021 | Berenberg | Initiates Coverage On | Hold |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Analyst Color Long Ideas REIT Guidance Price Target Analyst Ratings Trading Ideas Real Estate Best of Benzinga