2 Verizon Charts Worth Tracking

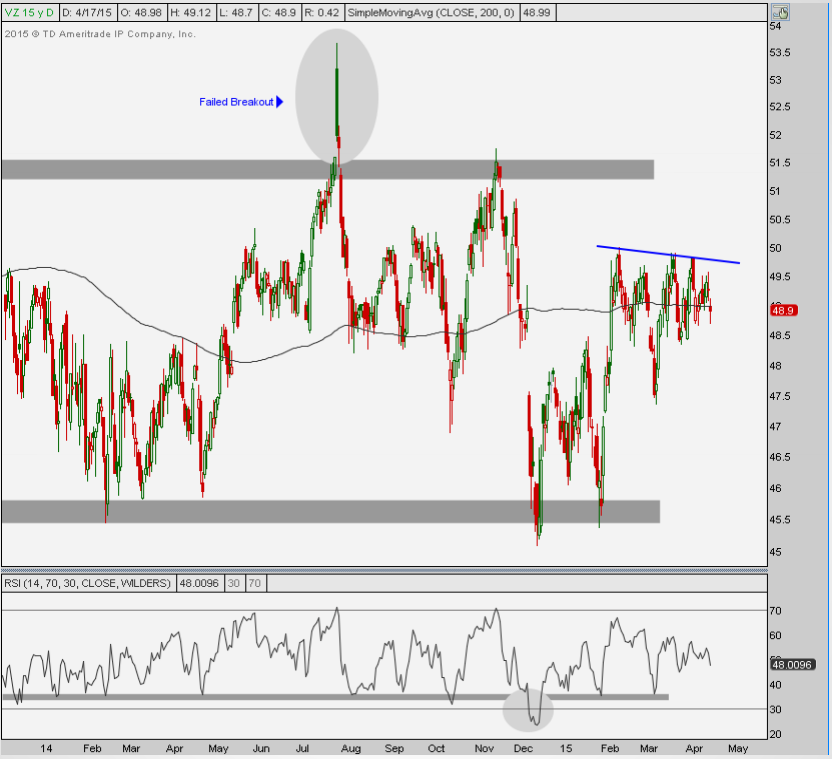

Structurally, Verizon Communications Inc. (NYSE: VZ) is still consolidating above its 2007 highs. The chart below, taken from Eagle Bay Capital's latest Dow Thirty report, illustrates this.

JC Parets, founder of Eagle Bay and Market Technician, thinks that “with an upward sloping 200 week moving average, the benefit of the doubt continues to go to the bulls, especially with momentum in a bullish range.”

However, with relative strength breaking multi-year support, the expert is worried about Verizon. He explains he does not want to be long if the stock price is “below this downtrend line from 2013 and former resistance/support since 2007 highs.”

But, if this key support is broken, “the next target is down towards 41 based on former support and 61.8% Fibonacci extension from the 2013 rally.”

Parets assures he would be a seller above $51 –- the resistance level of the past couple of years.

Looking at the shorter-term, a flat 200-day moving average has led to a neutral stance.

The specialist explains that, “with momentum hitting oversold conditions confirming a new bearish range,” his team thinks “profits should be taken quickly back near 49. These flat 200 day moving averages increase the likelihood of whipsaws which is precisely what has occurred the past few months.”

He concludes: “This is an overall messy situation and as nice of a trade as that was, we've suggested taking profits quickly and still feel that way.”

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Dow Thirty Eagle Bay Eagle Bay Capital Eagle Bay Solutions JC ParetsAnalyst Color Technicals Trading Ideas