Oppenheimer And Zillow: Model Adjusted Amid Trulia Acquisition, Shares Rebounding

On Tuesday, Oppenheimer & Co. Inc. (Opco) published a note updating their model on Zillow Group Inc (NASDAQ: Z) after CEO Spencer Rascoff lowered Zillow guidance for FY 2015.

Opco's Zillow Highlights

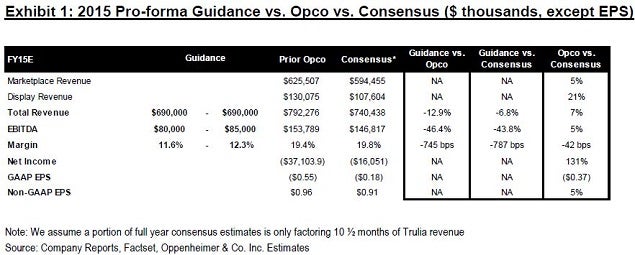

- FY 2015 EBITDA lowered to just $80 - $85 million vs. a prior consensus of approximately $146 million.

- FY 2015 adjusted sales of $690 million vs. prior consensus of $753 million.

- Trulia sales business was disrupted by both the FTC delays in allowing integration of the efforts with Zillow, as well as the closing of the Trulia San Francisco sales office and elimination of 350 previous positions.

- Rascoff announced that while existing customers will still be supported, he is winding down Trulia's market leader advertisings/CRM sales agent platform.

Tale Of The Tape

Zillow shares have continued to rebound since the conference call, closing up over 4 percent at the closing bell on Wednesday.

Zillow shares have traded in a 52-week range of $81.07 to $161.90.

Oppenheimer – Zillow Group: Maintains Perform Rating

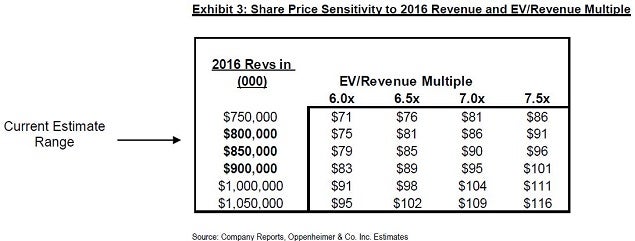

There was no Opco 12 - 18 month price target given for Zillow Group.

However, a price range table is included in Opco Exhibit 3 below based upon current revenue assumptions and various EV/Enterprise Value multiples.

Oppenheimer – Zillow Group: Updated Guidance

Of note, Opco lowered 2015E and 2016E estimates 13 percent and 17 percent, respectively, on lower revenue of market leader and Trulia.

Opcos's 2015E and 2016E EBITDA margins "decreased 749bps/724bps on lower sales assumptions; as a result, EBITDA decreased 46 percent and 40 percent, respectively," the report stated, and the long-term model assumes Zillow captures "14 percent/23 percent market share of overall real estate/online real estate advertising spend."

Oppenheimer – Zillow Group: Revised 2016 Revenues/Sensitivities

Zillow revenue guidance of a 19 percent increase Y/Y represents a considerable deceleration from the 54 percent in 2014.

The EBITDA guidance was 46/44 percent below Opco/Street and integration delays were due to slower than anticipated FTC approvals. Lower Trulia revenue negatively impacted margins.

Oppenheimer – Zillow Management Takeaways

Opco noted, "Zillow's core is operating at full capacity," and not impacted by the Trulia merger and related FTC approval delays in integration.

Zillow "expects ARPA to outweigh net subs in terms of growth," Opco stated. Notably, Zillow is not seeing a change in the competitive dynamics from News Corp (NASDAQ: NWSA)'s acquisition of Move, Inc., the operator of realtor.com.

Furthermore, Opco said, "Management guided that the loss of the ListHub contract will not materially impact revenue, and Z now has more active listings than if it were still operating under the prior ListHub contract."

Zillow intends to lower the advertising expense of Trulia throughout 2015 and reiterated expense synergies totally $100 million for 2016.

Image Credit: Public Domain

Latest Ratings for Z

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Jefferies | Assumes | Buy | |

| May 2021 | Deutsche Bank | Maintains | Buy | |

| Apr 2021 | Needham | Initiates Coverage On | Hold |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Move Inc. Oppenheimer & Co. Realtor.comAnalyst Color Guidance Analyst Ratings Trading Ideas Real Estate Best of Benzinga