Why These Analysts Still Love American Tower

On April 1, JPMorgan released an update on global cell tower REIT American Tower Corp (NYSE: AMT), including the rationale behind its new December 2015 price target of $110 per share, in light of American Tower's recent $5 billion acquisition of Verizon Communications Inc. (NYSE: VZ)'s U.S. wireless towers.

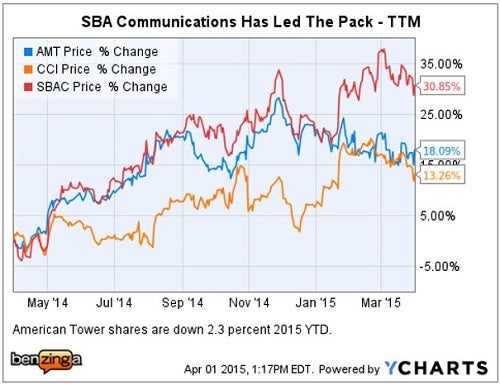

The firm also weighed in on American Tower's two communication tower sector peers: Crown Castle International Corp (NYSE: CCI) and SBA Communications Corporation (NASDAQ: SBAC).

Tale Of The Tape - Past Year

JPMorgan feels that these tower companies remains attractive, and ranks them in this order:

1. SBA Communications - Overweight, $140 PT

2. American Tower - Overweight, $110 PT

3. Crown Castle - not rated as of Feb. 5, 2015; however, JPMorgan noted CCI's 4 percent yield as being attractive for income investors, but at the cost of lower total returns.

The SBAC $140 PT represents a 19.5 percent potential upside from its March 31, close of $117.10 per share. JPMorgan is a market maker for shares of SBA Communications.

JPM - American Tower: Overweight, $110 PT

- JPMorgan's $110 price target represents a 16.8 percent potential upside from its March 31, close of $94.15 per share.

- This December 2015 price target is based on an "updated DCF analysis, using a discount rate of 7.0%, a terminal growth rate of 3.0% in 2020, and a 10% private-to-public discount."

- Previously, in December 2014, JPMorgan had rated AMT Overweight with a $121 PT.

JPM - AMT: Verizon Towers Acquisition

- American Tower closed the Verizon tower transaction on March 30, 11,448 towers for $5.053b in cash; JPMorgan estimates "AMT paid 21.5x TCF (tower cash flow) and 23.6x EV/EBITDA."

- JPMorgan noted that "from 1.4 tenants per tower we believe there is substantial lease up potential from AT&T, Sprint and T-Mobile."

- The firm estimates that this Verizon tower acquisition will be neutral to AFFO for the first year.

JPM - AMT: Foreign Exchange (FX)

- JPMorgan lowered its Q1 2015 international tower revenue estimate by $6 million, to $350 million.

- For FY 2015, the firm reduced its international leasing revenue estimate by $41 million to $1.404 billion, "due to FX headwinds."

- JPMorgan estimates do not include two deals which have yet to close TIM Brazil, and Bharti Airtel Nigeria.

- "Pro forma for the VZ deal and after adjusting for currency [JPM estimates] ~30% of American Tower's revenue comes from its international operations."

- Notably, JPMorgan singled out Brazil as being an FX risk moving forward in 2015.

JPM - AMT Price Target Risks

- Price Multiple Contraction: "Since 2002, the tower companies have gone from trading at less than 10x forward EBITDA to ~15-20x today;" with AMT currently trading at an estimated 17.2x forward EBITDA basis.

- Sprint/Nextel iDEN Shutdown: This could represent a potential 2 to 3 percent industry headwind.

- Debt Refinancing: "American Tower has leverage of ~5x, and most of its debt matures in the 2015 to 2024 time frame."

- Carrier Consolidation: Although viewed as unlikely by JPMorgan, another major consolidation would represent a headwind for the entire industry.

- International Expansion: An unforeseen ramp up in foreign investments would increase FX risks and potentially change the AMT risk profile.

JPM - Bottom Line

A potential tailwind for American Tower stock is that JPMorgan believes "the company could buy back stock once its leverage falls below 5x."

American Tower "offers an attractive risk/reward at this level," analysts conclude.

Latest Ratings for AMT

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Wells Fargo | Maintains | Overweight | |

| Mar 2022 | Barclays | Maintains | Overweight | |

| Mar 2022 | Credit Suisse | Maintains | Outperform |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Bharti Airtel TIM BrazilAnalyst Color REIT Price Target Initiation Analyst Ratings Real Estate