Stifel Weighs In On Healthcare REITs, Interest Rates & Top Picks

On Wednesday, Stifel released a timely update on Healthcare REITs (HCREITs), noting that interest rates are "the tail that wags the dog." This report came out on a day the Fed signaled it was getting closer to raising short-term rates, perhaps as soon as June.

Stifel is taking a neutral stance on HCREITs as a group and expects increased volatility in this REIT sector, mainly due to interest rate related price movements.

The big three HCREITs by market cap are:

- Health Care REIT, Inc. (NYSE: HCN) at $25.8 billion, 4.4 percent yield

- Ventas, Inc. (NYSE: VTR) at $23 billion, 4.4 percent yield

- HCP, Inc. (NYSE: HCP) at $18.7 billion, 5.5 percent yield

Tale Of The Tape

The Vanguard REIT Index Fund (NYSE: VNQ) is a good proxy for the REIT sector.

According to Stifel, during the past year, Health Care REIT, Ventas and HCP are up 26.7 percent, 15.7 percent and 9.7 percent, respectively, as compared to 18.2 percent for the broader REIT sector.

Ventas, Inc. Maintains Buy Rating, New $80 PT

- Stifel also announced that it is reducing its price target on Ventas from $88 to $80 per share, which still represents a 12 percent upside from $70.29.

- The Stifel $80 PT was based in part on an 18.3x 2015 FAD, or AFFO multiple.

- Stifel noted the rise in the 10-Year Treasury Note rates to over 2 percent as being a factor

HCP, Inc. Maintains Hold Rating

- Stifel noted that it has rent coverage concerns with HCP's largest tenant, HCR ManorCare, and does not expect to see any near-term resolution with what are now considered to be fairly risky leases.

- In fact, ManorCare represents approximately 29 percent of HCP's revenues, with the next largest tenant being Brookdale Senior Living at approximately 19 percent.

Health Care REIT Maintains Buy Rating

- Stifel views both HCN and Ventas as likely outperformers relative to HCP, Inc. in the near term.

Consider These Smaller HCREITs

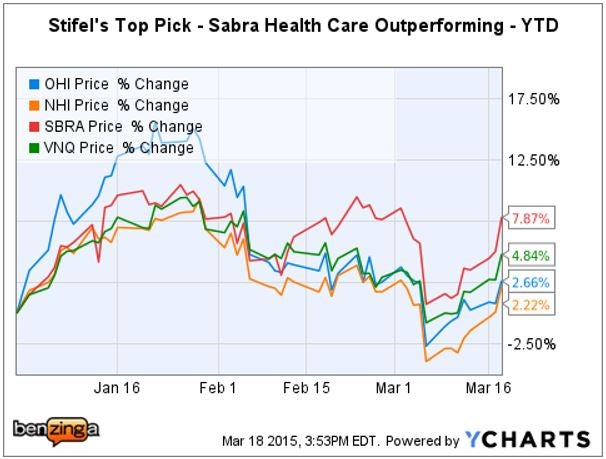

In light of potential interest rate hikes, Stifel suggests that these three smaller, faster growing HCREITs could pay off for investors:

- Sabra Health Care REIT Inc (NASDAQ: SBRA)(NASDAQ: SBRAP) – $1.9 billion cap, Buy Rated, Stifel Select List, Current Yield: 4.9 percent.

- Omega Healthcare Investors Inc (NYSE: OHI) – $5.5 billion cap, Buy Rated, Current Yield: 3.7 percent.

- National Health Investors Inc (NYSE: NHI) – $2.6 billion cap, Buy Rated, Current Yield: 4.9 percent.

In addition to faster growth rates helping to mitigate interest rate risk, Stifel also views M&A to be another potential catalyst for these smaller HCREITs to outperform.

Latest Ratings for VTR

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | BMO Capital | Upgrades | Market Perform | Outperform |

| Mar 2022 | RBC Capital | Maintains | Outperform | |

| Feb 2022 | Credit Suisse | Initiates Coverage On | Neutral |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Brookdale Senior LivingAnalyst Color REIT Health Care Price Target Analyst Ratings General Real Estate Best of Benzinga