Deutsche Bank: Strong Dollar Will Hurt U.S. Lodging Stocks

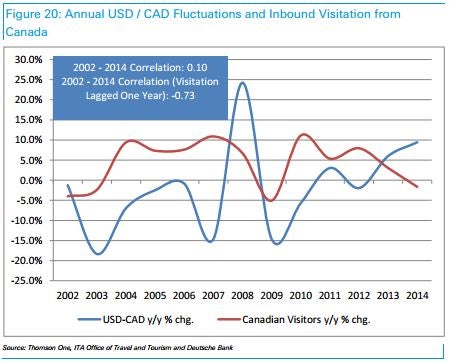

In a recent report, analysts at Deutsche Bank addressed the effect that the strong U.S. dollar will have on domestic lodging stocks. In particular, the report focused on the likely decline of international tourism in 2015 coming from Canada and Europe. Analysts believe the strong dollar will discourage international travelers from visiting the U.S. this year.

Projections

Analysts believe that a falloff in international visitors from Europe and Canada will shave about 30 basis points off of year-over-year domestic lodging growth in 2015. For 2014, the report indicates that about 7 percent of domestic room nights were sold to Canadian and Western European visitors. In 2015, analysts see a 4.3 percent decline in this number based on historical trends.

Overall, analysts are forecasting 2015 U.S. demand growth of 2.6 percent, well shy of the 2014 demand growth of 4.5 percent.

How Much Does It Matter?

The growth in international visitor numbers has been a strong overall driver of the lodging business in the U.S. over the last decade. Since 2003, domestic room nights for international visitors (excluding visitors from Canada and Mexico) have grown 7.6 annually versus the 1.5 percent overall annual growth rate of the lodging industry. During this time, analysts estimate that international visitors have gone from accounting for about 7.0 percent of U.S. occupied room nights to about 12.5 percent of U.S. occupied room nights.

Stock Picks

Despite the headwinds to the lodging industry from the dollar, Deutsche Bank maintains a positive overall outlook for a pair of stocks in the space. Deutsche Bank has a Buy rating on Starwood Hotels & Resorts Worldwide Inc (NYSE: HOT) and Hyatt Hotels Corporation (NYSE: H).

Deutsche Bank has Hold ratings on Mariott International Inc (NASDAQ: MAR) and Host Hotels and Resorts Inc (NYSE: HST).

Latest Ratings for HOT

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Sep 2016 | Citigroup | Terminates Coverage On | Neutral | |

| Aug 2016 | Citigroup | Maintains | Neutral | |

| Jul 2016 | Canaccord Genuity | Terminates Coverage On | Hold |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Deutsche Bank Lodging IndustryAnalyst Color Long Ideas Travel Analyst Ratings Trading Ideas General Best of Benzinga