PIMCO on Spain: It's Too Late to Act

PIMCO has published a report on Spain ahead of the much anticipated ECB meeting this week. The analysts at the famed bond management company expect a lackluster response that is more of a band-aid than the proverbial nuclear option.

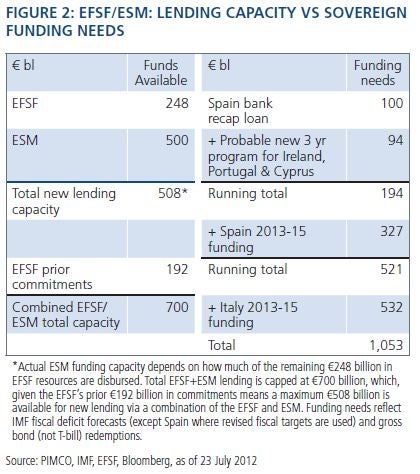

The first point the analysts make is that the firepower to buy bonds is limited if it comes through the bailout funds. The European Stability Mechanism (ESM), the permanent bailout fund, has lots of firepower, however it does not yet exist. Until the German parliament can approve the fund, which is not expected to occur until mid-September now, the 500 billion euros of capital it has will not be deployed.

The temporary bailout fund, the European Financial Stability Facility (EFSF), only has about 250 million euros remaining, according to the analysts. So, this amount of capital could be deployed to support ailing sovereign debt markets by buying bonds on the secondary market, but it is not a large amount of money compared to the size of sovereign bond markets.

As the above picture shows from PIMCO, it is simply a matter of math that the joint bailout funds are not big enough. Through 2015, the funds would need more than 1 trillion euros for support of markets and governments, however there is only a total capacity of 700 billion euros. Thus, the thesis is that the ECB has to step up and assume a larger role, which has been discussed widely at Benzinga.

The belief is that an ideal strategy to preserve the currency union would be for the ECB to step in and use its balance sheet to purchase bonds, something that it has been against throughout the crisis. The ECB does have the Securities Market Program (SMP), a facility in which it purchases bonds to cap yields, however this has been inactive for 20 weeks now. The analysts at PIMCO believe that a strategy where the ECB buys bonds and the remaining capital of the joint bailout funds used in tandem could be the ultimate solution. They posture that the EFSF/ESM combination could backstop losses on bonds purchased by the ECB, which would lessen fears of outright purchases at the ECB. Such a step would be a large one and would surely restore confidence to markets.

Sadly, this is not PIMCO's base case for the upcoming announcements. They write, "unfortunately, the political environment does not appear conducive to such a decisive policy response this summer. Key eurozone governments, such as Germany, want greater ceding of fiscal sovereignty first, a very difficult political task for the countries involved, and the ECB remains reluctant to provide direct funding to the EFSF/ESM." They note that rate cuts and further LTRO's are likely and potentially a small restart of the SMP, but nothing that is the so-called game-changer.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Analyst Color News Bonds Previews Forex Global Econ #s Economics Best of Benzinga