Mark Zuckerberg Already Made It To 'Step 1' By Naming His Goat Bitcoin — Now Investor Dials Meta To Ask Him To Add BTC To Company's Reserves

Matt Cole, CEO of Strive Asset Management, publicly called on tech behemoth Meta Platforms Inc. (NASDAQ:META) on Wednesday to buy Bitcoin (CRYPTO: BTC) for its balance sheet.

What happened: Cole dialed the company from the Bitcoin 2025 conference in Las Vegas, listing the benefits of adding Bitcoin to corporate reserves.

"The reality is that the corporate balance sheet in cash and short-term reserves is losing its ability to generate value for shareholders almost every single day," Cole said, citing a "global fiat debt crisis." Cole also highlighted potential disruptions from artificial intelligence over the next ten years.

Cole addressed Mark Zuckerberg, stating that the CEO had already done step one by naming his goat “Bitcoin.”

“You have already done step one. You have named your goat Bitcoin,” Cole stated. “My ask is that you take step two and adopt a bold corporate Bitcoin treasury strategy," Cole added.

Meta didn't immediately return Benzinga's request for comment.

See Also: From Warren Buffett’s Berkshire Hathaway To Jeff Bezos’ Amazon — Bitcoin Is Now Outshining These Wall Street Titans

Why It Matters: Earlier in January, Meta shareholders had reportedly requested the company's board to conduct an assessment and determine if adding Bitcoin was in its best interest.

Strive, co-founded by entrepreneur-turned-politician Vivek Ramaswamy, is an asset management firm known for its advocacy and optimism about Bitcoin.

It previously sent a letter to video game retailer GameStop Corp. (NYSE:GME), recommending it add Bitcoin to its reserves. Earlier this week, the company made its first purchase, buying 4,700 BTC for $512.6 million.

Price Action: At the time of writing, BTC was exchanging hands at $106,010.69, down 0.91% in the last 24 hours, according to data from Benzinga Pro.

Shares of Meta were down 0.70% in after-hours trading after closing 0.23% higher at 645.05 during Thursday’s regular trading session.

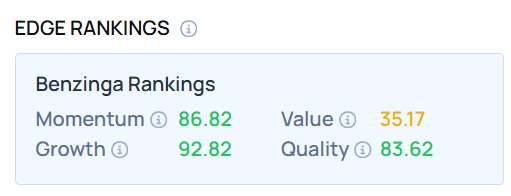

It demonstrated a very high growth score— a measure of a stock’s combined historical expansion in earnings and revenue across multiple time periods,—as of this writing. Benzinga Edge Stock Rankings can help you determine how it compares to other “Magnificent 7” stocks.

Photo Courtesy: Kemarrravv13 on Shutterstock.com

Read Next:

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Bitcoin Mark Zuckerburg Matt Cole Meta Strive Asset ManagementCryptocurrency News Markets