Robinhood Submits Proposal To SEC To Regulate Tokenized Assets As Brokerage Firm Seeks To Modernize Wall Street Rules

Commission-free trading firm Robinhood Markets Inc. (NASDAQ:HOOD) proposed a federal framework to the U.S. Securities and Exchange Commission for tokenized real-world assets, according to a report dated Tuesday.

What Happened: Robinhood’s letter, addressed to SEC Chair Paul Atkins and Commissioner Hester Peirce, outlined a plan for a unified national framework for bringing real-world assets on-chain, according to Forbes.

Robinhood’s proposal suggested replacing the current fragmented, state-by-state compliance approach with a unified national framework. The proposal also stated that tokens representing assets, such as equities or government bonds, should be legally equivalent to the underlying asset, not classified as derivatives or synthetic products.

Robinhood also pushed for allowing broker-dealers like itself to custody and trade tokenized assets using existing regulatory guardrails, not separate, uncertain structures.

Why It Matters: Robinhood’s push for bringing real-world assets on blockchain rails is not new. Earlier in January, CEO Vlad Tenev backed the tokenization of private company shares, arguing that it would allow the general public to invest in these firms early in their development.

Tenev reaffirmed this vision during the company’s first quarter earnings call earlier this month, stating that they have the technology to tokenize shares of firms such as SpaceX and OpenAI, but what is required is “comprehensive securities legislation.”

Real-world asset tokenization has emerged as one of the hottest cryptocurrency narratives in recent years. BlackRock, the world’s largest asset management firm, introduced BUIDL, a tokenized U.S. Treasury product built on Ethereum (CRYPTO: ETH), last year.

Anthony Moro, CEO of Provenance Blockchain Labs and a known industry expert, predicted tokenization to become a trillion-dollar market by 2030.

Price Action: Shares of Robinhood dipped 0.71% in pre-market trading after closing 1% higher at $64.91 during Tuesday’s trading session, according to data from Benzinga Pro. Year-to-date, the stock has gained over 74%.

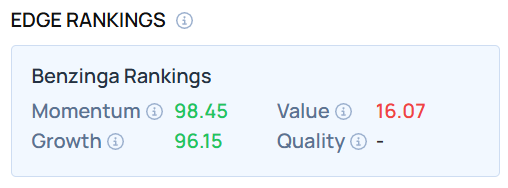

The stock exhibited high momentum and growth scores as of this writing. Benzinga Edge Stock Rankings can help you see how other cryptocurrency-focused companies stack up on these metrics.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Image Via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Robinhood SEC TokenizationCryptocurrency News Markets