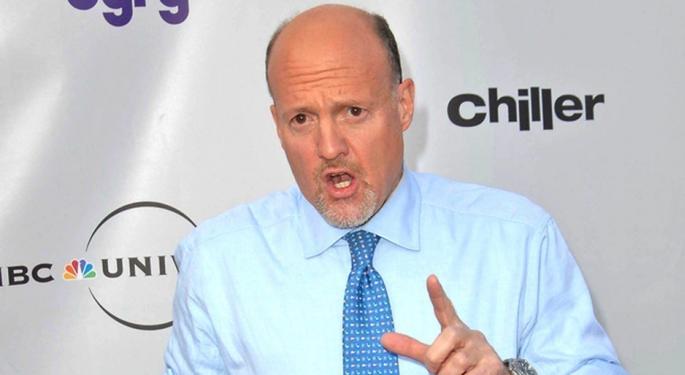

Jim Cramer: Sunrun Had 'Bad Couple Of Quarters,' ExlService Holdings Is 'Solid'

On CNBC's “Mad Money Lightning Round,” Jim Cramer recommended buying BlackRock, Inc. (NYSE:BLK). “Long term, I think it's going to be a great position,” he added.

Lending support to his choice, BlackRock reported a first-quarter adjusted EPS beat in April and announced that assets under management reached historic highs.

“We're not recommending stocks right now that are losing a lot of money because we think this could be a dicey environment,” Cramer said when asked about Tempus AI, Inc. (NASDAQ:TEM).

On the earnings front, Tempus AI will report financial results for the first quarter on Tuesday, May 6.

Cramer said no to Sunrun Inc. (NASDAQ:RUN), adding that the company reported a “bad couple of quarters.”

Supporting his view, Citigroup analyst Vikram Bagri, on April 17, downgraded the rating for Sunrun from Buy to Neutral and announced a $7 price target.

The Mad Money host said he likes ExlService Holdings, Inc. (NASDAQ:EXLS), adding that it is “one of the fintech stocks that's been proving to be very solid.”

Lending support to his choice, ExlService Holdings posted better-than-expected earnings results for the first quarter on April 29.

Cramer said he wants to buy Union Pacific Corporation (NYSE:UNP) right here as he likes this level.

On the earnings front, Union Pacific, on April 24, reported quarterly operating revenue of $6.027 billion, flat year-over-year, missing the consensus of $6.08 billion

Price Action:

- BlackRock shares gained 0.2% to settle at $916.14 on Thursday.

- Tempus AI shares rose 0.4% to close at $51.85 during the session.

- Sunrun shares gained 4.4% to settle at $7.19 on Thursday.

- ExlService shares fell 4.5% to close at $46.31.

- Union Pacific shares fell 0.7% to settle at $214.08 on Thursday.

Read Next:

Image: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: CNBC mad money Lightning Round Jim CramerTop Stories