Top 5 Trending Stocks: Palantir, Hertz, Netflix, Prologis, Tesla

The stock market experienced significant declines on Wednesday as Federal Reserve Chair Jerome Powell addressed economic concerns. The S&P 500 fell 2.2% to 5,275.70 points, while the Nasdaq dropped 3% to 16,307.16. The Dow Jones Industrial Average fell 1.7% to 39,669.39. The tech sector faced substantial losses, with semiconductor companies particularly affected by new export restrictions.

These are the top stocks that gained the attention of retail traders and investors throughout the day:

Palantir Technologies Inc. (NASDAQ:PLTR)

Palantir shares decreased by 5.78%, closing at $92.71. The stock reached an intraday high of $97.30 and a low of $89.62, with a 52-week range between $125.41 and $20.33. The decline came as Powell’s remarks on tariffs and economic slowdown concerns weighed on the tech sector.

Hertz Global Holdings Inc. (NASDAQ:HTZ)

Hertz shares soared by 56.44%, closing at $5.71, with an intraday high of $5.77 and a low of $4.06. The stock’s 52-week range is $6.65 to $2.47. The surge followed Pershing Square’s significant stake in the company, as revealed in an amended 13F filing.

Netflix Inc. (NASDAQ:NFLX)

Netflix saw a 1.50% decline, closing at $961.63. The stock hit an intraday high of $981.21 and a low of $949.17, with a 52-week range of $1,064.50 to $542.01. Investors are eyeing Netflix’s upcoming earnings report for guidance amid the tariff war environment.

Prologis Inc. (NYSE:PLD)

Prologis shares rose by 1.84%, closing at $100.29. The stock reached an intraday high of $101.91 and a low of $97.98, with a 52-week range of $132.57 to $85.35. The increase followed the company’s strong first-quarter earnings report, which exceeded expectations. Prologis president Dan Letter said that the company signed leases totaling 58 million square feet and expanded capacity to support growing demand for data centers.

Tesla Inc. (NASDAQ:TSLA)

Tesla shares fell by 4.94%, closing at $241.55. The stock’s intraday high was $251.97, with a low of $233.89, and a 52-week range of $488.54 to $138.80. Investors are eagerly awaiting Tesla’s upcoming shareholder meeting for updates on key issues. Shareholders will demand answers on self-driving, Cybercab, tariffs and brand damage.

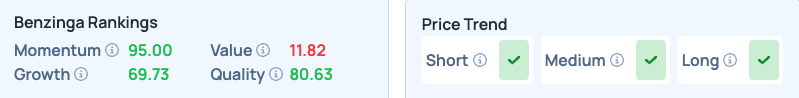

Benzinga Edge Stock Rankings for Netflix indicate Momentum at 95th percentile and Growth at 69th percentile. How does rival Disney fare? Find out by clicking here now.

Prepare for the day’s trading with top premarket movers and news by Benzinga.

Photo Courtesy: chayanuphol on Shutterstock.com

Read Next:

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: electric vehicles EVs Hertz hertz global NetflixEquities News Markets