Meta Wins Ruling To Block Whistleblower Who Worked With Mark Zuckerberg And Sheryl Sandberg — Book Alleges Harassment And Shady China Strategy

On Wednesday, Meta Platforms, Inc. (NASDAQ:META) won an emergency legal ruling to block the promotion of a memoir written by a former high-ranking employee who claims the company ignored sexual harassment complaints and quietly built censorship tools for China.

What Happened: Sarah Wynn-Williams, who worked at Facebook from 2011 to 2017 and interacted with top executives, including CEO Mark Zuckerberg and then-COO Sheryl Sandberg, released a book titled “Careless People” this week.

In it, she accuses Joel Kaplan, Meta's longtime policy chief, of making remarks she reported as sexual harassment, reported the New York Times. Wynn-Williams also accuses Sandberg of inappropriate behavior while describing her “Lean In” narrative as a cover for “unspoken rules” about “obedience and closeness,” according to the Times.

Wynn-Williams also alleged that Meta developed censorship tools to win favor with the Chinese Communist Party, a claim she echoed in a whistleblower complaint filed with the SEC in April.

See Also: Apple Delays Next-Gen Siri: ‘It's Going To Take Us Longer Than We Thought' To Deliver AI Upgrades

Meta responded by filing an emergency motion, citing a violation of a 2017 non-disparagement agreement.

The arbitrator ruled in Meta's favor, barring Wynn-Williams from promoting or further distributing the book, and ordering her to retract prior remarks. "Immediate and irreparable loss will result in the absence of emergency relief," the arbitrator wrote.

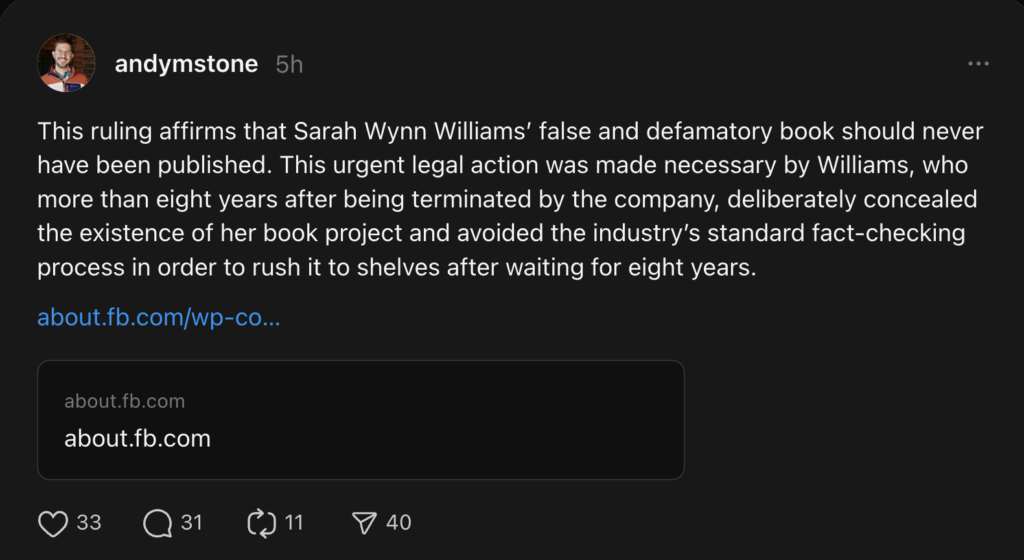

Meta spokesperson Andy Stone took to Threads and called the book "false and defamatory," adding that Wynn-Williams "deliberately concealed" the project and avoided industry-standard fact-checking.

Why It's Important: Earlier this week, Meta was highlighted as a lucrative investment due to its less leveraged position compared to other tech giants, despite the underperformance of the ‘Magnificent 7’ stocks in 2025.

Zuckerberg's company is working on reducing its dependency on suppliers like Nvidia Corporation by developing its own AI chips with Taiwan Semiconductor Manufacturing Co.

In the competitive landscape of the Interactive Media & Services industry, Meta remains a dominant player with nearly 4 billion monthly active users across its “Family of Apps.”

Price Action: Meta’s stock closed Wednesday’s regular session at $619.56, rising 2.29%. In after-hours trading, it added another 0.47%. Year to date, the stock is up 3.39%, and over the past 12 months, it has climbed 23.97%, according to Benzinga Pro data.

Read Next:

Image via Shutterstock

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: benzinga neuro Joel Kaplan Mark Zuckerberg Sarah Wynn-WilliamsNews Legal Tech Media