Clorox Beats Expectations Despite 15% Sales Drop, CEO Stays Confident In Q4 Growth

Clorox Co.’s (NYSE:CLX) second-quarter earnings and revenue exceeded expectations, however, its net sales declined 15% annually. The management reinstated confidence in its fourth-quarter forecast expecting mid-to-high-single-digit growth in organic sales driven by the Enterprise Resource Planning (ERP) implementation.

What Happened: ERP refers to a software system upgrade that Clorox is implementing to modernize its core business processes, including supply chain, finance, and other operational areas. The transition is expected to be completed in phases over six months.

During its earnings call the company CEO Linda Rendle said, “ERP transition is a very important step in our digital transformation, continuing to ensure that we have data and can move at the right speed with the right capabilities to enable the growth and productivity that we’re driving.”

While the company guided its third-quarter organic sales to be up low-single digits, with an impact from divestitures and forex, CFO Kevin Jacobsen said, “The ERP transition will add 1 to 2 points of growth over the course of the year, it’s all going to happen in Q4.”

Why It Matters: Clorox exceeded analysts’ expectations, reporting revenue of $1.69 billion and adjusted earnings of $1.55 per share. Despite a 15% decline in year-over-year net sales, the company improved its gross margin to 43.8% and increased operating cash flow to $401 million.

Clorox anticipates being at the higher end of its 11-13% free cash flow target as a percentage of sales before the ERP impact. The ERP implementation will likely bring it closer to the low end of the range due to inventory build and pre-paying suppliers.

Price Action: Shares of Clorox rose 0.69% to end Monday at $159.78 apiece. The exchange-traded fund tracking the S&P 500 index, SPDR S&P 500 ETF Trust (NYSE:SPY) declined 0.67% to $597.77 on Monday.

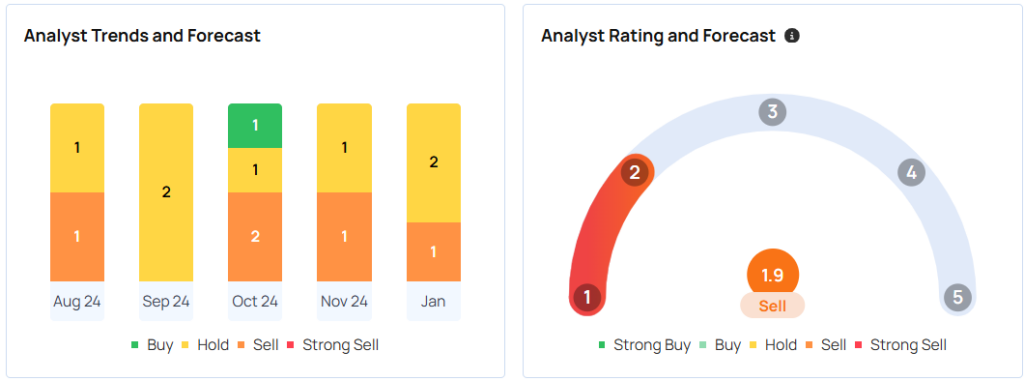

The average price target among 22 analysts tracked by Benzinga is $151.4 with a ‘sell' rating. The estimates range from $120 to $187 apiece. Recent ratings from RBC Capital, Barclays, and JP Morgan suggest a $150.33 target, implying a potential downside of 3.34%.

Read Next:

Photo courtesy: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Earnings Enterprise Resource Planning ERPEarnings Equities Market Summary News Markets